Internal Controls Dashboard

The Internal Controls Dashboard provides a centralized view of key metrics critical to maintaining strong internal controls. It offers timely insights to help departments monitor compliance, identify risks, and support sound financial stewardship.

The Internal Controls Dashboard is available from the Business Analytics Hub (bah.ucsd.edu) under the Leadership (Restricted) tab.

The dashboard includes:

- Reconciliation

- Default Project Status

Access

Staff who are in leadership positions and do not currently have access should submit a ticket indicating why access is needed and attaching approval of the MSO or other departmental leader.

- Navigate to bah.ucsd.edu.

- Select Budget & Finance.

- If using the List View, look for Internal Controls Dashboard in the list or use the search bar at the top right and click the dashboard name

- If using the Card View, click the Leadership (Restricted) tab and click Launch on the Internal Controls Dashboard tile

Navigation

- You will land on the Reconciliation page by default, but you can use the buttons on the top bar to navigate to the other reports/dashboard pages.

- Each report has its own set of prompts located at the top of the page. These prompts are independent of one another—applying filters on one report will not affect the others.

Reconciliation

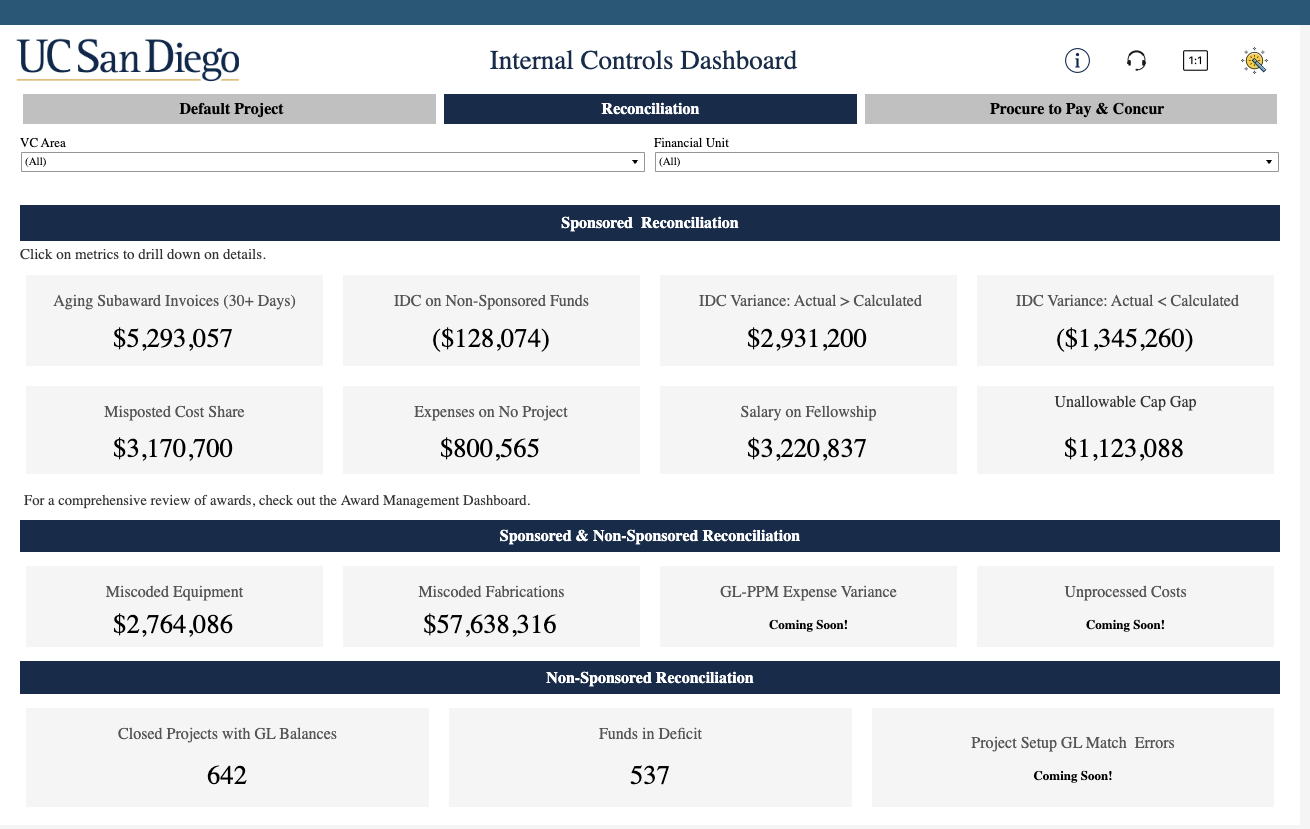

Summary of the report

The Reconciliation page of the Internal Controls Dashboard highlights key reconciliation metrics across awards and the general ledger. It helps departments quickly identify issues such as miscodings, variances, unprocessed costs, and deficit balances to support accurate financial reporting and compliance. This page utilizes various views from the Financial Activity Hub, Research Activity Hub, and Employee Activity Hub.

Navigation

- Use these parameters to filter for the data you want to view.

- This report can be filtered by VC Area and by Financial Unit.

Business Scenarios

- Are we at risk of compliance issues due to delayed payments?

- Is indirect cost recovery being handled correctly?

- Are funds being charged to incorrect categories or projects?

- Is salary appropriately distributed on sponsored projects?

Report Views

Reconciliation page: Click on each metric to view details.

Reconciliation page: Click on each metric to view details.

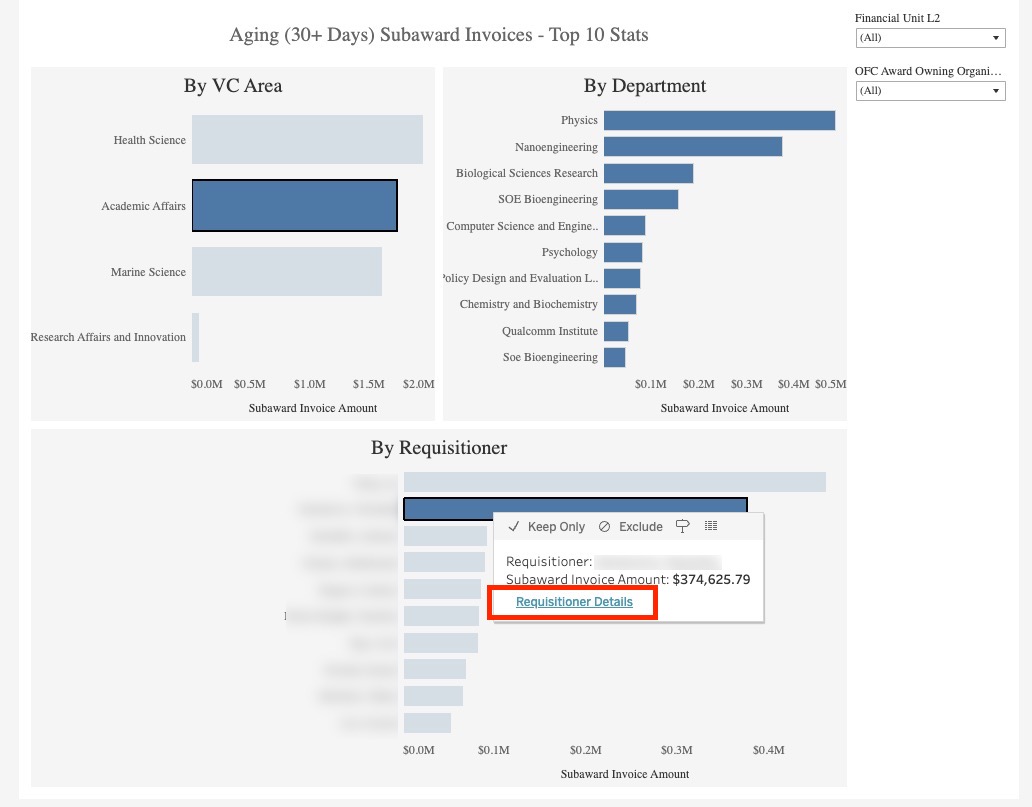

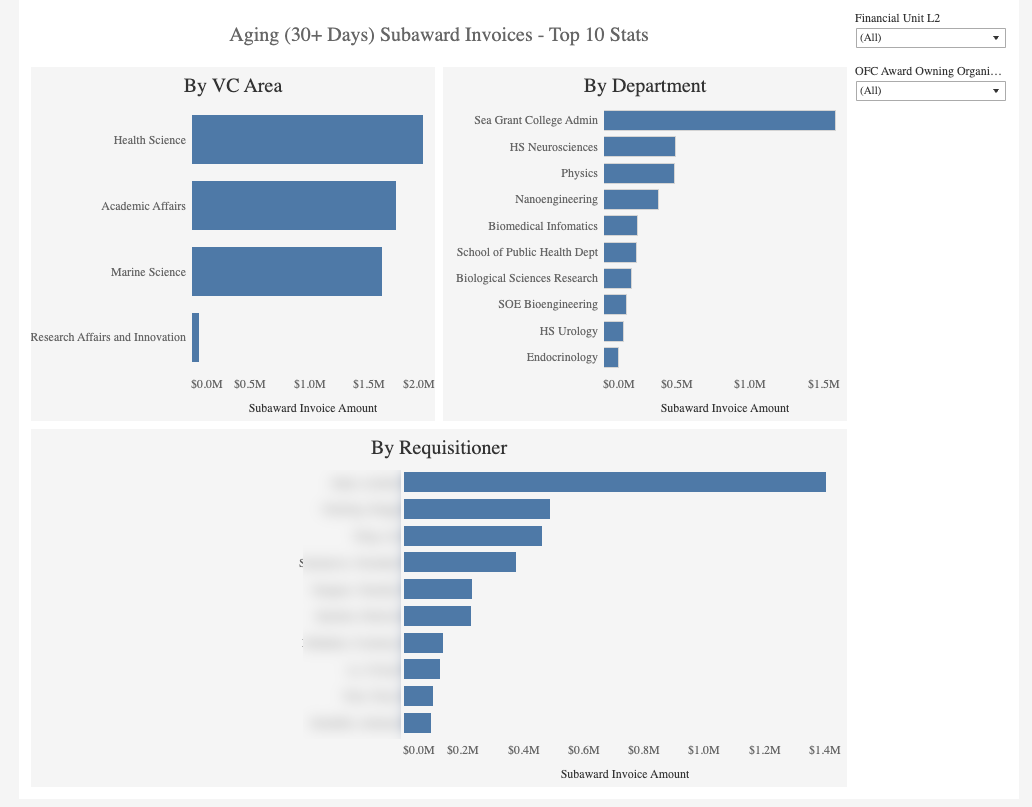

Aging (30+ Days) Subaward Invoices - Top 10 Stats: first-level drillthrough landing page that appears after clicking on any metric on the main Reconciliation page. It shows the top 10 contributors to aging subaward invoices, breaking down overdue invoice amounts by VC Area, Department, and Requisitioner. Click on a specific VC Area or Department to dynamically filter down the other graphs for more focused analysis.

Aging (30+ Days) Subaward Invoices - Top 10 Stats: first-level drillthrough landing page that appears after clicking on any metric on the main Reconciliation page. It shows the top 10 contributors to aging subaward invoices, breaking down overdue invoice amounts by VC Area, Department, and Requisitioner. Click on a specific VC Area or Department to dynamically filter down the other graphs for more focused analysis.

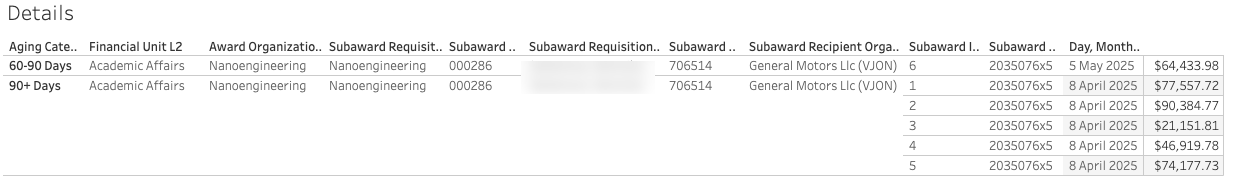

Requisitioner Details: second-level drillthrough landing page that appears after clicking on any requisitioner on the Aging (30+ Days) Subaward Invoices page.The table breaks down invoice data related to a specific requisitioner and provides detailed information about individual subaward transactions.

Requisitioner Details: second-level drillthrough landing page that appears after clicking on any requisitioner on the Aging (30+ Days) Subaward Invoices page.The table breaks down invoice data related to a specific requisitioner and provides detailed information about individual subaward transactions.

What To Do

| Metric | Description | How to Resolve | Companion Report for Transactors |

|---|---|---|---|

|

Aging Subaward Invoices |

Subaward invoices that were received over 30 days ago and have not yet been approved. The aging report helps research administrators and financial managers track and manage outstanding invoices, identify potential issues, and ensure timely payment or approval. |

Visit the FAQ for Subaward Invoices and Payments for more information. |

|

|

IDC on Non-Sponsored Funds |

Indirect costs on cost share internal funds should not post to the General Ledger. Indirect costs in the GL on non-sponsored/internal funds reflect a transaction processing error that must be corrected. |

To access IDC on Specific State Appropriations or other non-sponsored projects, you must have the UCSD PPM PADUA Write User JR role to be granted access to PADUA 2.0. Non-sponsored projects that need IDC assessed need to be created in PADUA 2.0 with the project template "UCSD General Project with Burdening". The default IDC is Total Direct Costs 20%, but can be changed as needed |

|

|

IDC Variance |

IDC variances refer to the differences between the expected and actual indirect costs (IDC) charged to a project. These variances can occur due to various reasons such as changes in the project scope, modifications in the budget, or errors in the calculation of IDC. |

Identify the projects with variances and reach out to the SPF Accountant to make the corrections. |

|

|

Misposted Cost Share |

An external funding source was used with a cost share project or task, or an internal funding source was used with a non-cost share project or task. Cost share project or task defined as one with a burden schedule starting with 'INT.' |

|

Consolidated Exceptions Report: Misposted Misc Receipts on SP |

|

Misposted Miscellaneous Receipts |

Sponsored Projects should have miscellaneous receipts posted as a credit to expense or applied towards an invoice. |

After identifying a mis-posted miscellaneous receipt end users should complete and submit the Subledger Transaction Correction Form (select Receivables and Cash Management from the dropdown menu) Helpful Links: |

Consolidated Exceptions Report: Misposted Misc Receipts on SP |

|

Salary on Fellowship |

Fellowship awards are awards to provide training, not employment. This report is intended to identify potential employment related costs that are charged to fellowship awards and are unallowable Per eCFR :: 2 CFR 200.466 – Scholarships and student aid costs. (a) Costs of scholarships, fellowships, and other programs of student aid at IHEs are allowable only when the purpose of the Federal award is to provide training to selected participants and the charge is approved by the Federal awarding agency. |

Review their appointment to ensure that they are setup as trainees, not employees. Please work with your SPF Accountant or submit via Services and Support ticket if you have any questions or concerns. |

Consolidated Exceptions Report: Salary on Fellowship Award |

|

Unallowable Cap Gap |

Unallowable cap gap refers to the amount of salary that exceeds the allowable salary cap for a particular project or award. The unallowable cap gap is calculated as the difference between the job compensation rate and the monthly NIH cap rate, multiplied by the UCSD Labor Ledger salary derived effort percent. This amount is considered unallowable because it exceeds the maximum allowable salary cap set by the funding agency, and therefore, cannot be charged to the project. The report provides a summary of the unallowable cap gap charged to awards, which can be used to identify and correct any errors or discrepancies in salary charging. The consequences of not addressing unallowable cap gaps can be significant and may include:

|

To resolve unallowable cap gaps, the following steps can be taken:

|

|

|

Miscoded Equipment |

Expenditure type starts with 163003 (Capital Equipment) and the total invoice amount is less than $5,000 |

Look at the line item description to identify what was purchased. If the purchase does qualify as equipment (acquisition cost => $5,000 and useful life > one year), then okay. If the item is not equipment, complete and submit the Subledger Transaction Correction Form. Select 'Payables Invoices or Payables Payments' from the dropdown menu, and then complete the Accounts Payable Cost Correction Request Excel spreadsheet. |

|

|

Miscoded Fabrications |

Expenditure type starts with 163001 and neither the project nor the task contain the word "fab" |

|

|

|

GL-PPM Expense Variance |

Coming Soon! |

||

|

GL-PPM Budget Variance |

Coming Soon! |

||

|

Unprocessed Costs |

Coming Soon! |

|

|

|

Closed Projects with GL Balance |

|

Assets (1XXXXX)

Liabilities (2XXXXX) Refer to the journal source on the transactions causing a balance.

Net Position and Changes in Net Position (300000 and higher) Transfer resources or expenses to bring the balance to zero. If balances of accounts starting with 3 and higher net to zero, these can be disregarded. They will come off the report at the start of the next fiscal year. |

Consolidated Exceptions Report: Closed Projects with GL Balance |

|

Transactions on No Project |

This report does not include transactions that are intended to post with no project segment, such as sponsored fund revenue or cash transactions. |

Transactions on sponsored funds must be posted to a project. Correction of sponsored fund transactions without a project is required. Transactions on non-sponsored funds may be posted to a project or without a project at the department's discretion. To correct identified transactions, complete and submit the Subledger Transaction Correction Form. |

Consolidated Exceptions Report: Transactions on No Project |

|

Project Setup to GL Match Errors |

Coming Soon! |

Consolidated Exceptions Report: Project Setup to GL Match Errors |

|

|

Funds in Deficit |

Non-Sponsored funds with deficits greater than $25,000. For more information about the financial deficit policy, check out the Blink page here. |

Financial Resource Management Dashboard: Financial Deficit Report - Operating Funds |

For more technical information, see technical documentation.

Default Project Status

Summary

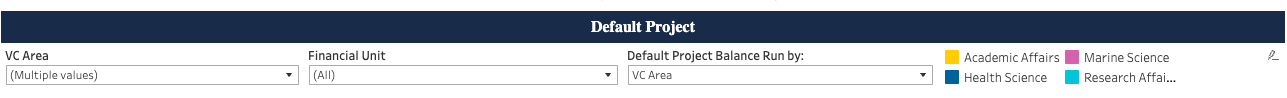

This report provides a comprehensive view of default project usage at UC San Diego. It identifies positions with no associated funding source or those with expiring projects, and highlights payroll and non-payroll expenses charged to default projects. The dashboard is designed to help financial staff monitor and correct inappropriate default charges in a timely manner.

Navigation

- Use these parameters to filter for the data you want to view.

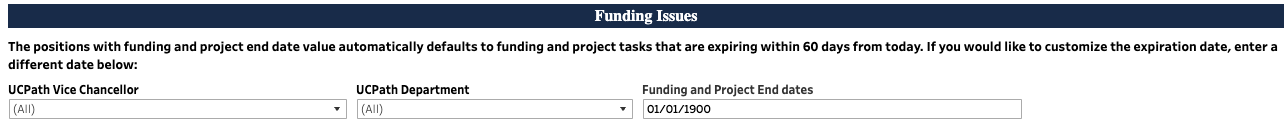

- The Funding Issues section, which includes three fields on top of the report, can be filtered by VC Area, by Department, and by Funding and Project End Dates.

The graphs below, showing payroll costs and default project amounts, can be filtered by VC Area and by FinUnit. The graph with Default Project Balance over time can also be run by VC or by Payroll vs. Nonpayroll.

Business Scenarios

- Which departments have the highest charges to default projects?

- How have default charges evolved over time?

- What payroll corrections are still pending by VC Area and year?

- Have we made progress correcting default charges?

Report Views

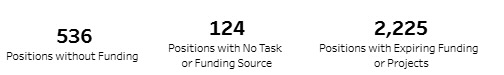

Funding Issues Indicators: these two figures serve as early warning indicators for payroll compliance issues.

- # of Positions without Funding

- # of Positions with No Task or Funding Source: the reason behind can be a chartstring missing a task (required for projects) or funding source (for sponsored projects)

- # of Positions with Expiring Funding or Projects: identifies positions where current funding or projects are about to expire or have already expired, triggering default charges unless proactively corrected.

By monitoring these numbers, fiscal staff can quickly prioritize which positions need immediate funding or task updates in UCPath or Oracle to avoid inappropriate default charges. Transactors should use the Funding Issues Report to identify the specific individuals reflected in these numbers.

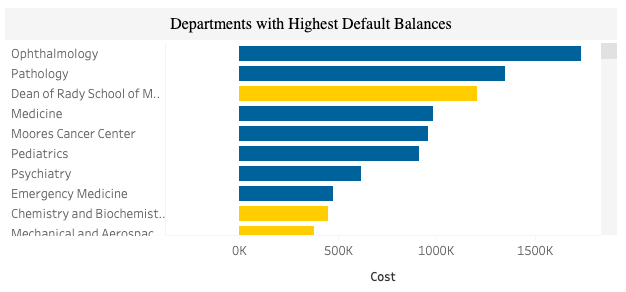

Departments with Highest Default Balances: It ranks departments based on the total dollar amount charged to default projects. It helps identify which departments are most heavily relying on default projects, either due to missing or expired funding setups. It enables users to target cleanup efforts and detect recurring issues in departments that frequently appear at the top.

Departments with Highest Default Balances: It ranks departments based on the total dollar amount charged to default projects. It helps identify which departments are most heavily relying on default projects, either due to missing or expired funding setups. It enables users to target cleanup efforts and detect recurring issues in departments that frequently appear at the top.

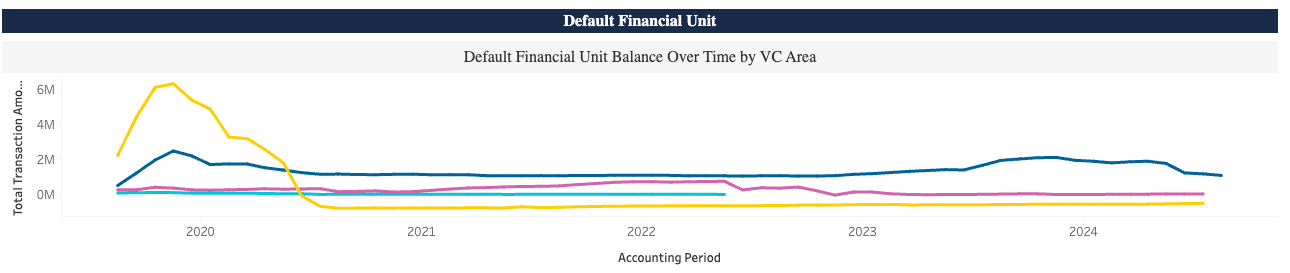

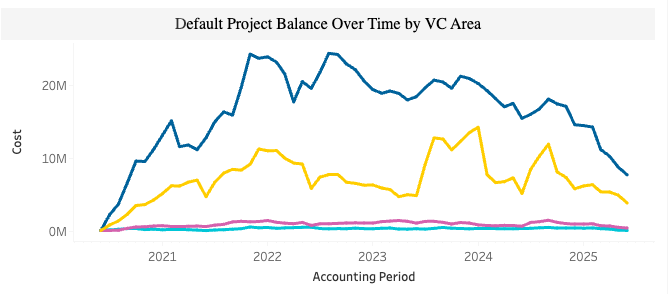

Default Project Balance Over Time by VC Area: This graph can be run by VC Area or by Payroll vs. Nonpayroll. It defaults to showing the cumulative balance of charges by VC Area. Presents trends from 2020 through 2025, allowing users to see whether default balances are growing, stabilizing, or being resolved:

Default Project Balance Over Time by VC Area: This graph can be run by VC Area or by Payroll vs. Nonpayroll. It defaults to showing the cumulative balance of charges by VC Area. Presents trends from 2020 through 2025, allowing users to see whether default balances are growing, stabilizing, or being resolved:

- A rising balance, especially in payroll, signals unresolved issues needing immediate attention — since payroll is often charged to sponsored projects and must be corrected for compliance.

- Non-payroll defaults, while less critical, still need to be addressed. These can include charges like Campus Admin Debit, Student Tuition and Fees, and Medical Center recharges.

The goal is to keep both lines as flat and minimal as possible, indicating timely resolution of funding issues. Departments seeing an upward trend should investigate and take corrective action promptly.

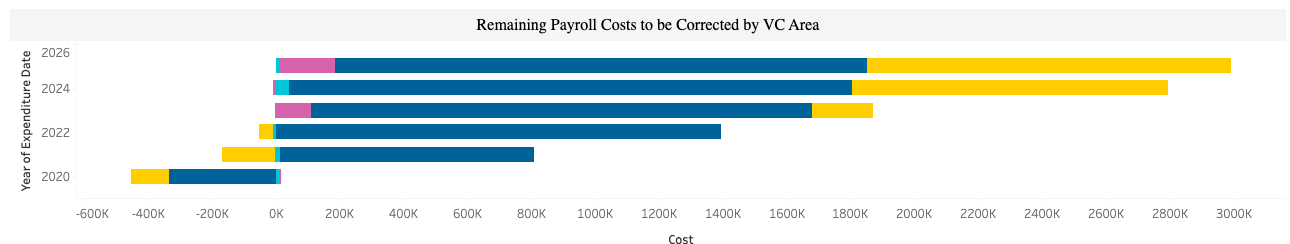

Remaining Payroll Costs to be Corrected by VC Area: Shows uncorrected payroll charges on default projects, grouped by VC area and fiscal year. It highlights which VC areas have the highest outstanding payroll balances needing correction. This helps leadership prioritize follow-up and track year-over-year progress in resolving default charges.

Remaining Payroll Costs to be Corrected by VC Area: Shows uncorrected payroll charges on default projects, grouped by VC area and fiscal year. It highlights which VC areas have the highest outstanding payroll balances needing correction. This helps leadership prioritize follow-up and track year-over-year progress in resolving default charges.

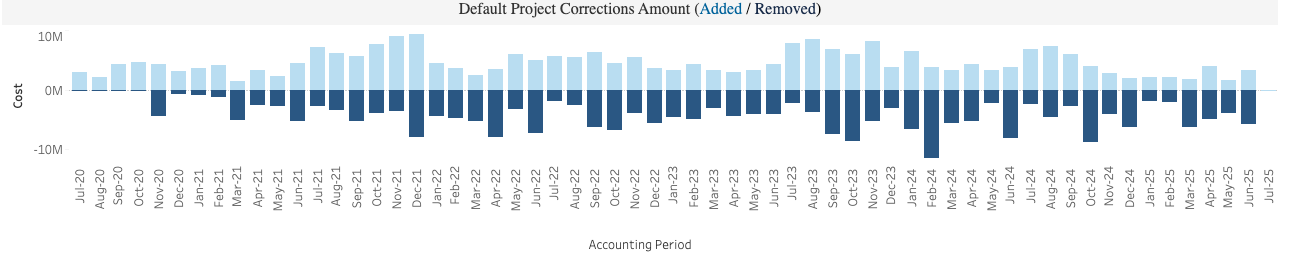

Default Project Corrections Amount: Assesses how much is being added to and removed from default projects each month. Ideally, the dark‑blue bars (removals) should display an overall increasing trend, while the light‑blue bars (additions) should trend downward. Dark‑blue bars should consistently be taller (in magnitude) than the light‑blue bars; if the two are equal for a given month, no net movement occurred. Monitoring this chart highlights months where corrections lag (additions exceed removals) and helps ensure default project balances are being cleared in a timely manner.

Default Project Corrections Amount: Assesses how much is being added to and removed from default projects each month. Ideally, the dark‑blue bars (removals) should display an overall increasing trend, while the light‑blue bars (additions) should trend downward. Dark‑blue bars should consistently be taller (in magnitude) than the light‑blue bars; if the two are equal for a given month, no net movement occurred. Monitoring this chart highlights months where corrections lag (additions exceed removals) and helps ensure default project balances are being cleared in a timely manner.

Default Financial Unit Balance Over Time by VC Area: In addition to the default project associated with each financial unit, each VC Area has a default financial unit. Costs post to the default financial unit in the General Ledger with no project. These typically arise when no default project has been created for a home department in UCPath.

Procure to Pay

Release Notes & Communications

| Date | Release Notes & Communications |

|---|---|

| 7/29/2025 Dedicated Email |

The Internal Controls Dashboard provides a centralized view of key metrics critical to maintaining strong internal controls. It currently includes two dashboard pages: Default Project Status and Reconciliation. A third page for Procure to Pay metrics will be added in the fall. This dashboard offers timely insights to help departments monitor compliance, identify risks, and support sound financial stewardship. |