Assessment Reconciliation Report

The Assessment Reconciliation Report helps users reconcile assessments like Differential Income and ASSA that are charged on certain revenues. The report calculates the assessments that should be charged and compares them to actual assessments. A GL Balance Summary includes uncharged assessments to provide a projected balance.

The Assessment Reconciliation Report is available from the Business Analytics Hub (bah.ucsd.edu) under the Exceptions and Reconciliation tab.Access

Access has been provisioned to anyone with the Oracle BI Consumer JR role. Staff who do not have access should request the Oracle role. Access failure appears as error "Unable to load requested view. Displaying home view instead."

- Navigate to bah.ucsd.edu.

- Select Budget & Finance.

- If using the List View, look for Assessment Reconciliation Report in the list or use the search bar at the top right and click the dashboard name

- If using the Card View, click the Exceptions and Reconciliation tab and click Launch on the Assessment Reconciliation Report tile

- Use your Active Directory credentials to sign in, if prompted.

Navigation

The Cognos and Oracle Tips & Tricks page shares various recommendations on navigating report functionality

Viewing the Report

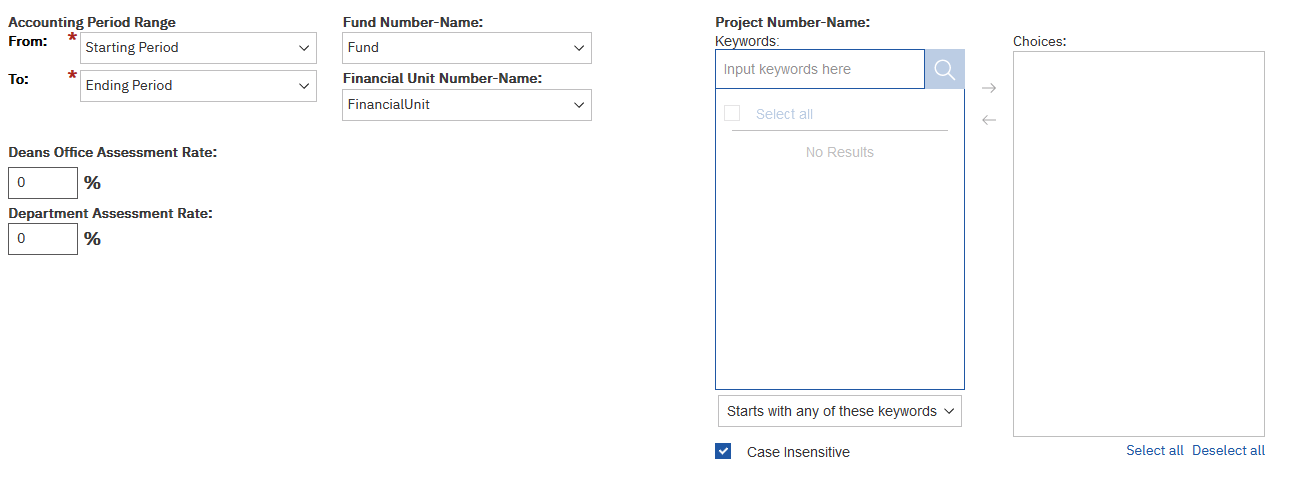

- Start by entering the starting and ending accounting period range.

- Enter fund number, financial unit, and/or project number. To see revenue and assessments that posted with no project, enter the financial unit and project 0000000.

- You can search for fund number or financial unit by clicking the prompt and begin typing the numbers.

- Search for your project number or key words in the project name. If using key words in the project name, change the drop down to “Contains any of these keywords.”

- If your department and/or Dean’s office charges differential income on revenues received, enter the appropriate percentages. Enter a 20% rate as 20.

Additional Information:

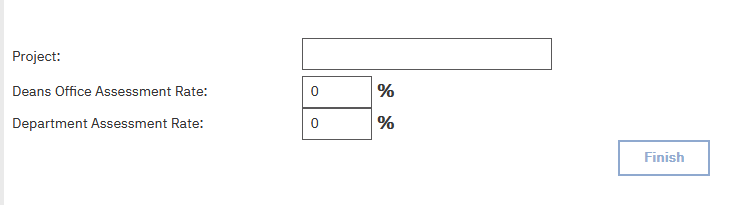

- After running the report, at the top of the page there are options to change the project and assessment rates.

Summary

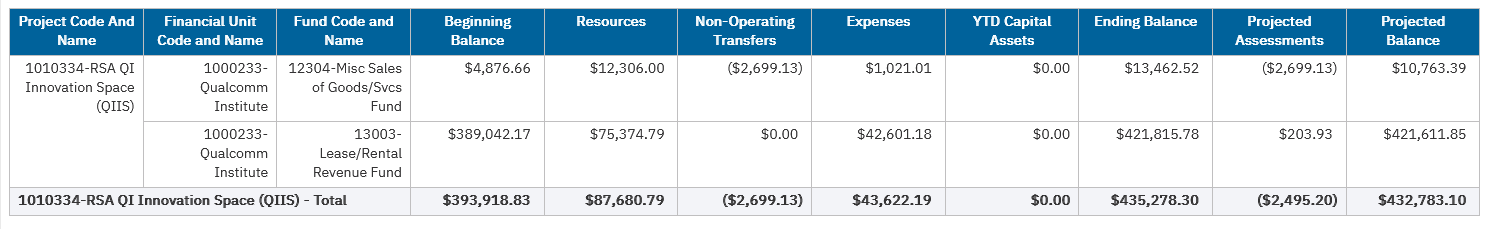

-

Provides beginning balance, activity, and ending balance for the fiscal year, and calculates a balance net of uncharged assessments.

Report View

Details

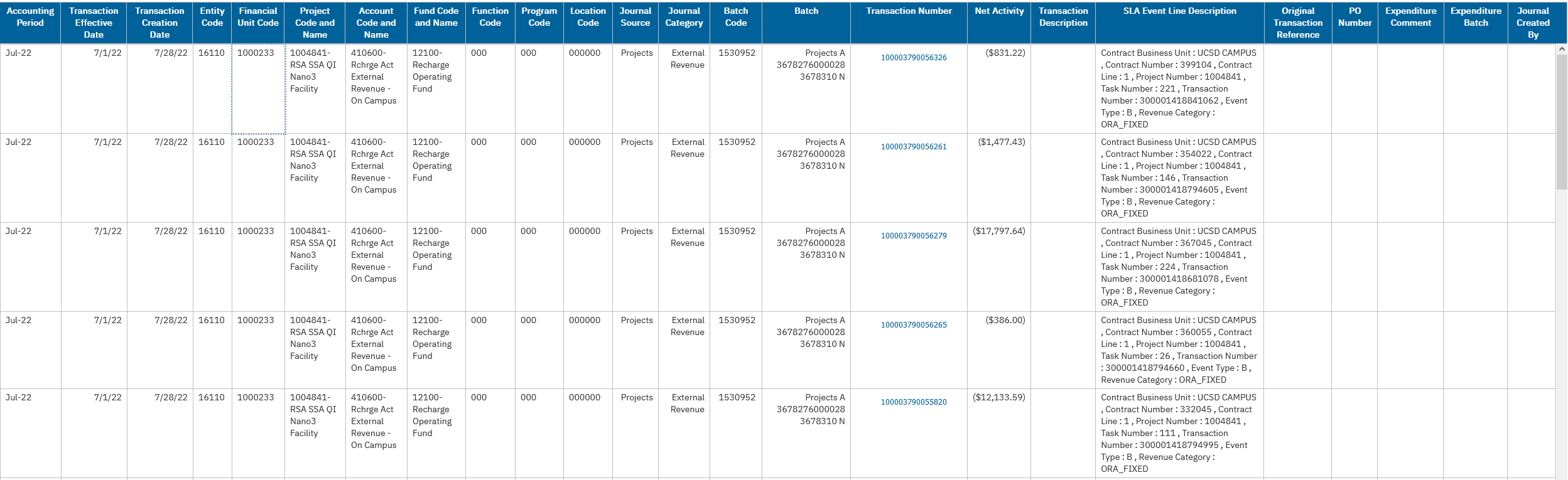

The detail sections display assessments calculated for Differential Income (DI) and ASSA, showing the different assessments that are charged on service agreements. These sections provide a breakdown of the calculated DI and ASSA amounts and show the total that should be charged by CBO, Department, and Dean's offices broken down by accounting period.

- There is typically a one-month lag between the month revenue posts and the month CBO assessments are charged. The calculated amount appears in the same month as the revenue it is calculated against. This lag allows for the necessary time to reconcile and finalize the calculations accurately.

- Additionally, there may be Systemwide assessments specific to the VCHS included in the Detail sections.

Report View

Revenue

Revenue Page:

- Provides a comprehensive view of all revenue transactions that Differential Income and ASSA assessments are based on, offering detailed information about each transaction.

Report View

Assessments

Assessments Page:

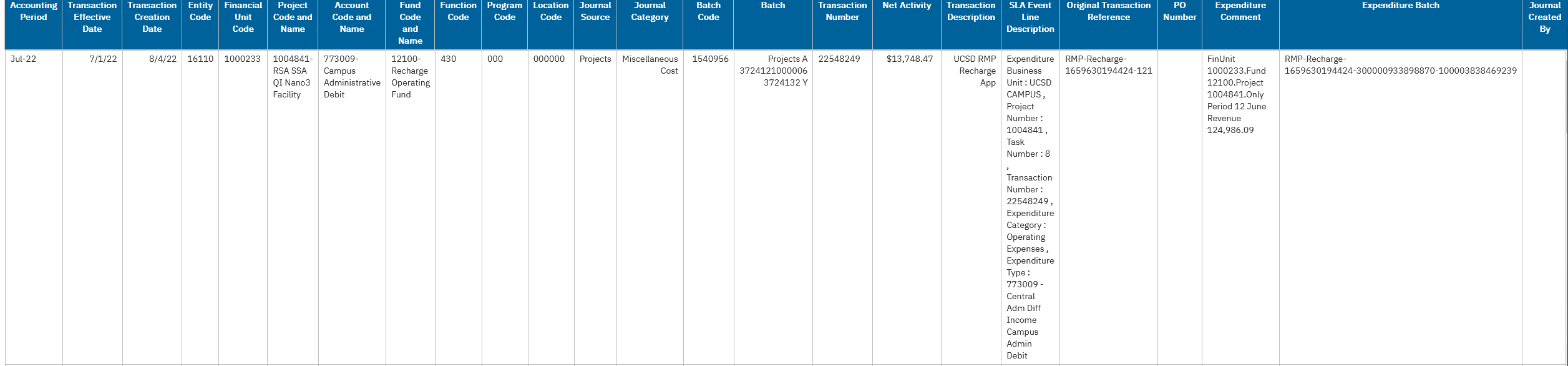

- Provides a comprehensive view of assessment-related transactions, offering detailed information about each assessment.

- The SLA Event Line Description provides details related to the associated cost transaction in PPM.

Report View

Release Notes & Communications

| Date | Release Notes & Communications |

|---|---|

| 06/30/2023 Dedicated Email |

The Assessment Reconciliation Report can help you reconcile assessments like Differential Income and ASSA that are charged by Campus Budget Office (CBO) as well as departments and Dean’s offices. The report calculates the Differential Income and ASSA amounts that should be charged by CBO based on percentages applied to certain fund codes and revenue codes. It compares the calculated amounts to amounts actually charged and then calculates a difference. Users have the option of entering a percentage to be applied to those same fund and revenue codes by departments and/or Dean’s offices, and again compares the calculated amounts to amounts actually charged. In addition, the report provides project- and fund-level balances net of any assessments yet to be charged. |

Additional Resources

- More information on Overhead Cost Recovery - Differential Income

- More information on How to Record Departmental Support Differential Income

- Demo of the report