Department Exceptions Panorama

The Department Exceptions Panorama is designed to highlight the transaction discrepancies and errors in the Oracle financial system.

The Department Exceptions Panorama is available from the Business Analytics Hub (bah.ucsd.edu) under the Exceptions and Reconciliation tab.

The dashboard includes:

- Transactions Incorrectly Posted to UCPath Specific Funds (CVR)

- Incorrect PPM Budget Resources

- Project and Task Transaction Controls

- Project Task Owning Org Mismatch

- Uncleared Concur AP Credit Memos

Report Demos

You can find the Incorrect PPM Budget Resources & PPM Budget Version Comparison Report Demos on the Budget & Finance MediaSpace channel - Financial Report Demos playlist.

Access

Access has been provisioned to anyone with standard inquiry and reporting access. Staff who do not have access should complete the Oracle and Concur Role Requests Form. Access failure typically appears as an inability to load prompt values.

- Navigate to bah.ucsd.edu.

- Select Budget & Finance.

- If using the List View, look for Department Exceptions Panorama in the list or use the search bar at the top right and click the dashboard name

- If using the Card View, click the Exceptions and Reconciliation tab and click Launch on the Department Exceptions Panorama tile

- Use your Active Directory credentials to sign in, if prompted.

Transactions Incorrectly Posted to UCPath Specific Funds (CVR)

Business Scenarios

- The purpose of this report is to track transactions that were incorrectly posted to UCPath specific funds

Data Selection and View Options

- Use these parameters to filter for the data you want to see

- These filters can be used in combination or individually to produce desired results

Report Views

- Results display in a default table with the ability to export the result set into a file

What to Do

- To correct, reach out to where the transaction originated from to have it adjusted (AP, AR, journal source, etc.)

Incorrect PPM Budget Resources

Business Scenarios

- The Incorrect PPM Budget Resources report will display any PPM Budgets with resource categories that do not match UCSD Expenditure Categories

- Using these Oracle categories is not recommended and can impact the view of other reports

- Use the Incorrect PPM Budget Resources report to identify both sponsored and general project budgets needing correction

Data Selection and View Options

- Use these parameters to filter for the data you want to see

- These filters can be used in combination or individually to produce desired results

Report Views

- Results display in a default table with the ability to export the result set into a file

What to Do

- Complete and submit the Subledger Transaction Correction Form.

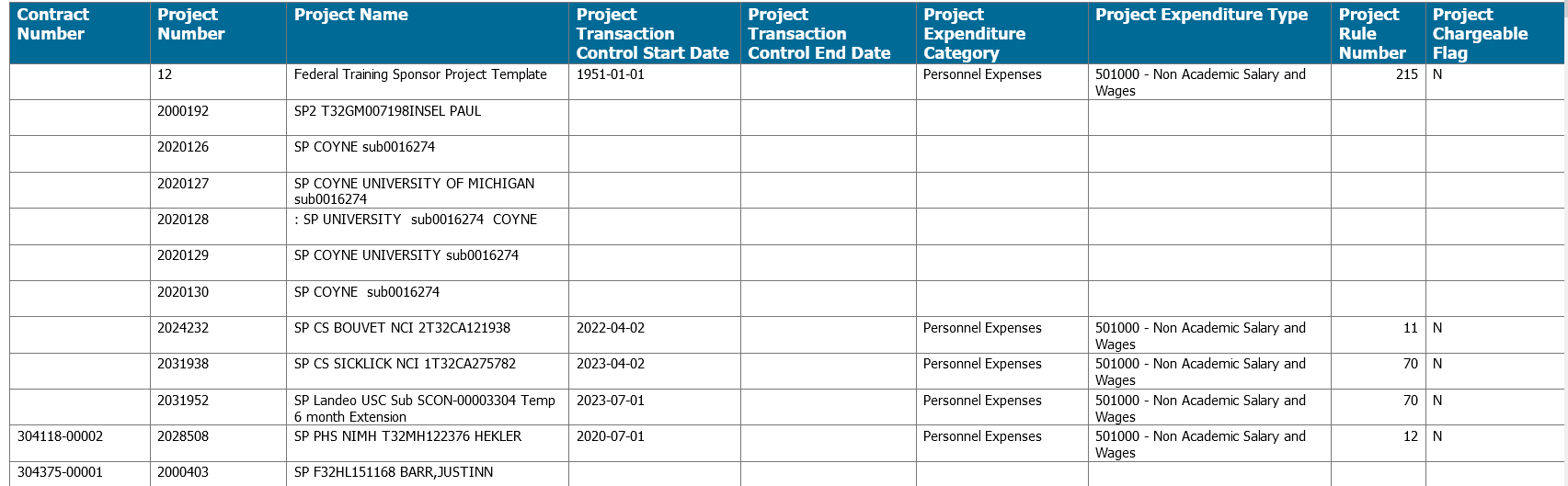

Project Transaction Controls

Business Scenarios

- This report allows you to compare the project template controls to the specific project and show total of costs that may have posted to those controls.

- Project transaction controls are available for Sponsored Projects and Capital Projects. Transaction controls are used to specify the type of transactions that are non-chargeable for the project and tasks. The list of unallowable expenditure types can be viewed by navigating to Projects, search for the desired project, from the menu click Manage Project Financial Settings, and select Transaction Controls.

- List of Project Transaction codes unallowable on federal awards.

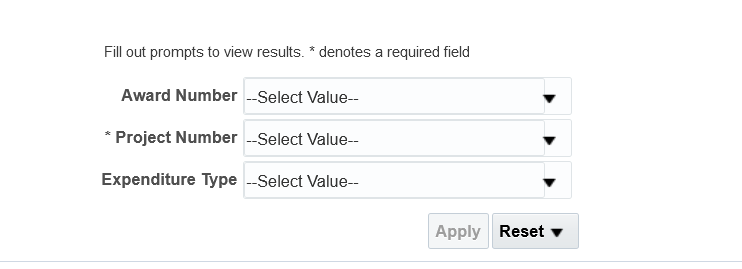

Data Selection and View Options

- Use these parameters to filter for the data you want to see

- These filters can be used in combination or individually to produce desired results

Report Views

- Refer to the Data Glossary under Get Started on the main BI & Financial Reporting Blink menu for searchable data descriptions and usage rules.

Project Task Owning Org Mismatch

Business Scenarios

- The Project Owning Organization drives Subledger Accounting Rules (SLAs)

- Task Owning Organization does not impact accounting but can be used in reporting

- Mismatches are identified on the basis of:

- Tasks where the task owning organization is different from the project owning organization**this may not be in error, but is reported for departments that do not want this differentiation

- Tasks where the task owning organization is UC San Diego

- Projects where the project owning organization is UC San Diego

Data Selection and View Options

- Use these parameters to filter for the data you want to see

Report Views

- Results display in a default table with the ability to export the result set into a file

What to Do

- Use this report to identify Projects or Tasks with wrong or potentially wrong owning organization.

- Update the Task Owning Organization in PADUA 2.0. Complete and submit the Subledger Transaction Correction Form

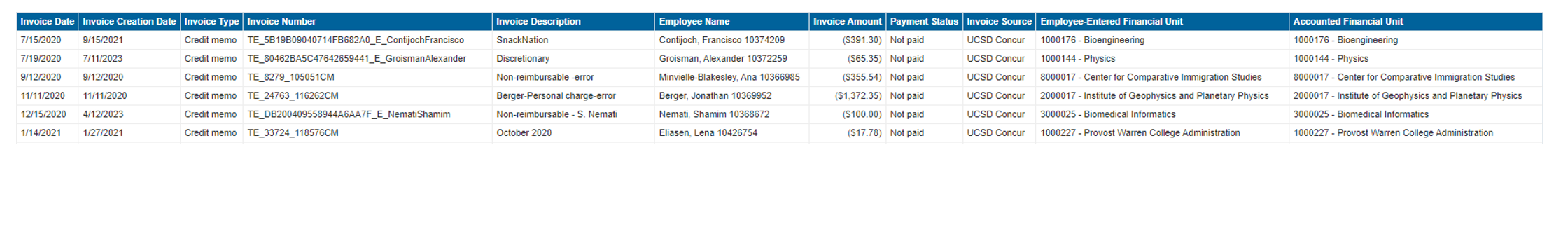

Uncleared Concur AP Credit Memos

Business Scenarios

This report displays Credit Memo details from Oracle Financials Cloud (OFC), created by Concur Expense Reports with a net amount owed by the employee as a result of Personal/Non-Reimbursable Card Charges, Cash Advance Returns or Travel Card Per Diem Offset.

Notes:

- A Credit Memo is generated if two conditions are met: (1) the Concur expense report must be approved and have the final status of “Sent for Payment”, and (2) the “Total Owed by Employee” amount is greater than $0.00 from the Concur expense report, as displayed in Report Totals under Report Details.

- Concur will automatically net any reimbursements owed to the employee within the same expense report with an amount greater than that of any Personal/Non-Reimbursable Card Charges, Cash Advance Returns or Travel Card Per Diem Offset, and pay the employee the difference. In this instance, the Total Owed by Employee would be $0.00 and a Credit Memo would not be generated.

- OFC will automatically net reimbursements from separate invoices/expense reports where the amount of one or more of the invoices/expense reports is greater than the uncleared Credit Memo. This will result in paying the difference between those transactions. In this instance, a Credit Memo will automatically be cleared and the employee will not need to deposit a check.

- OFC will not net reimbursements from separate invoices/expense reports where the total amount of the invoices/expense reports is less than the uncleared Credit Memo. The sum total of the invoices must be greater than the Credit Memo in order for OFC to offset the transactions.

- Credit Memos created as a result of Cash Advance Returns are listed under Financial Unit 5000051. Run this Financial Unit to identify individuals who have outstanding Cash Advance Returns. An enhancement request has been submitted to change the Financial Unit code.

- Note that an alternative solution is being explored to improve this process in the long term.

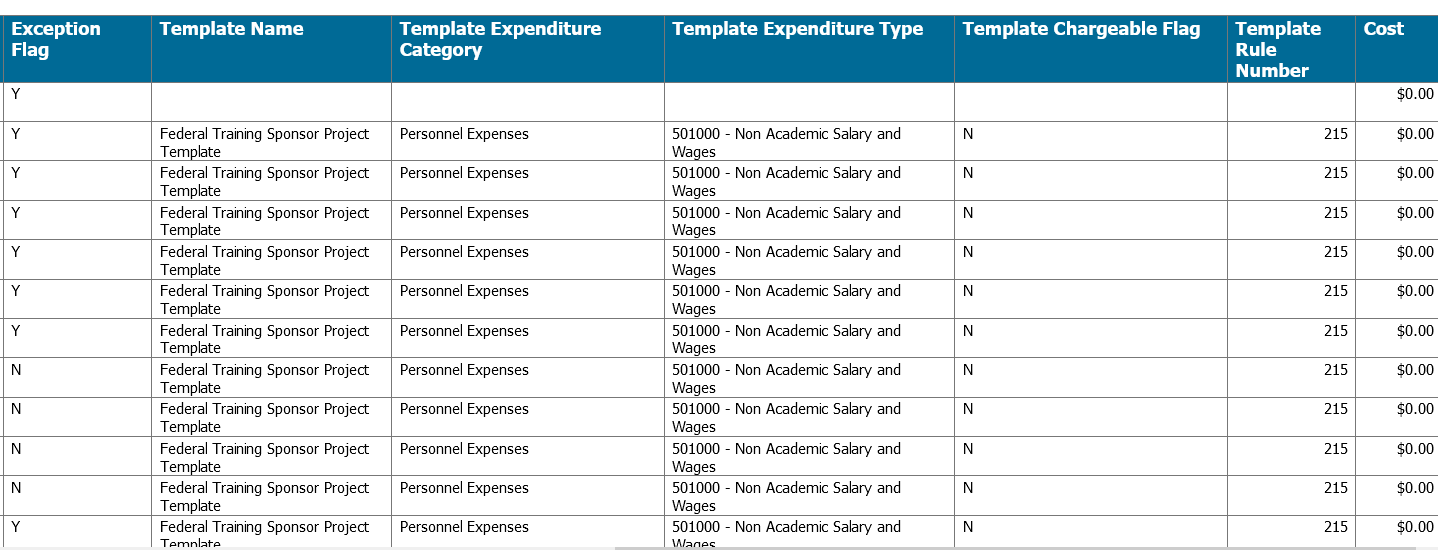

Data Selection and View Options

- Use these parameters to filter for the data you want to see

- These filters can be used in combination or individually to produce desired results

Report Views

- Results display in a default table with the ability to export the result set into a file

What to Do

- To clear an outstanding Credit Memo, the employee would need to submit a check to the Cashier’s office and fill out a Cashier’s Deposit Form through Services & Support. Include the employee name and the Invoice (Credit Memo) Number or Concur Report ID in the comments. Follow this KBA to use the correct chart string for the deposit.

- Do not submit a check if there is another expense report where the employee is owed funds greater than the Credit Memo amount (without the negative sign). OFC will automatically net the reimbursement with the Credit Memo and pay the employee the difference.

Release Notes & Communications

| Date | Release Notes & Communications |

|---|---|

| 12/10/2024 Budget & Finance Weekly Digest |

Central office subject matter experts have done a thorough review of the reports on the Department Exceptions Panorama and determined that some no longer need to be reviewed by departments. These reports have been removed:

The following reports only need to be reviewed by those who manage contracts and therefore have been moved to the Contract Management Dashboard:

|

| 06/13/2023 Budget & Finance Weekly Digest |

Misposted Miscellaneous Receipts on Sponsored Projects:

|

| 4/25/2023 Budget & Finance Weekly Digest |

BPM Aged Items: This report identifies the approval state/status of contracts, invoices, budgets, and project cost transfers. Worklist items become stale/stuck if not acted on in a timely manner. Misc receipts on SP that might be wrong: Sponsored Projects should have miscellaneous revenue posted as a credit to expense or applied towards an invoice. This report displays the miscellaneous receipt accounting and PPM accounting to reconcile and identify mismatches between the two modules. |