Overhead Cost Recovery - Differential Income

Find out more about Overhead Cost Recovery - Differential Income information and recovery..

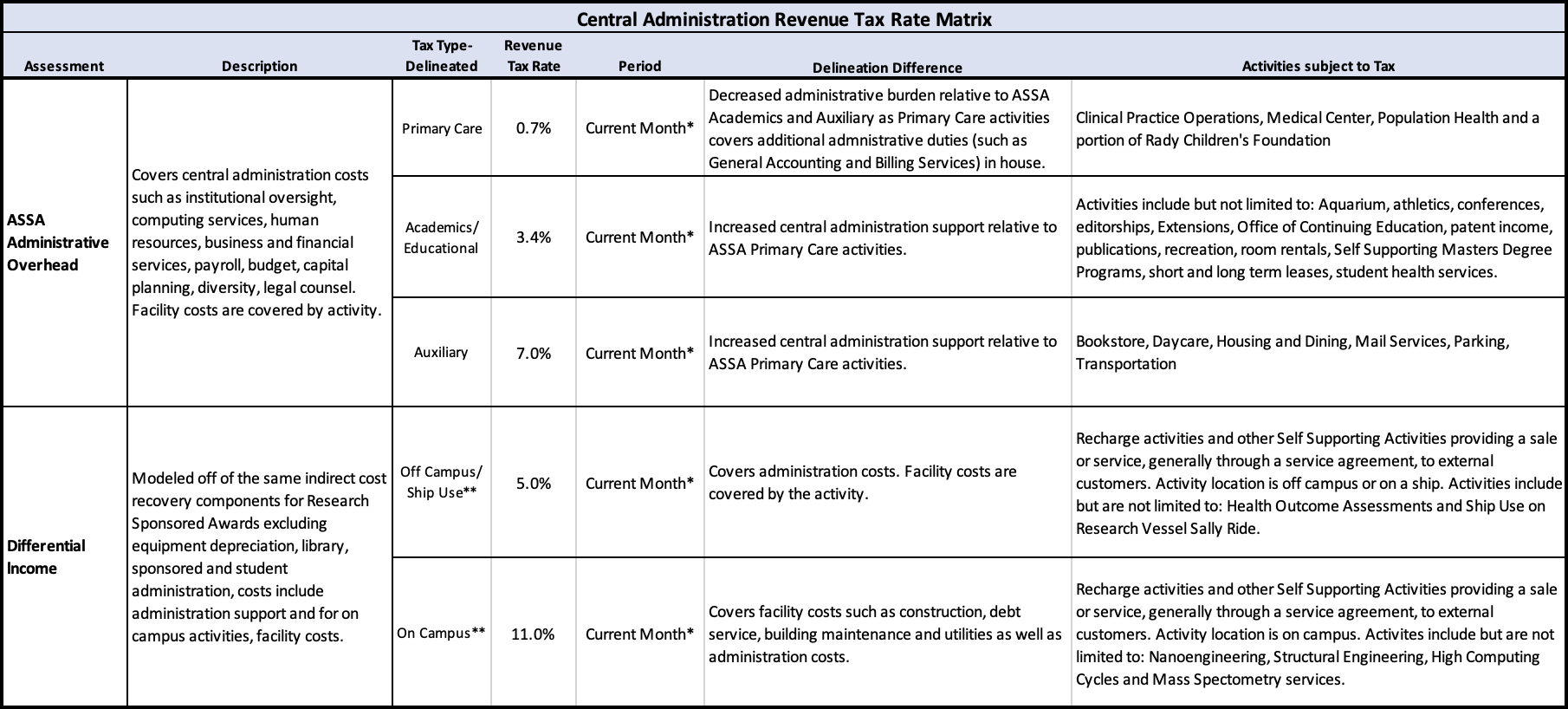

The overhead cost recovery rate, also referred to as Differential Income, is the rate applied to all sales to non-UC users of activities in order to recover the Indirect Costs related to the activity.

Overview

Rates are based on the current Federal negotiated research rate for the campus, less four components: Equipment Depreciation, Sponsored Project Administration, Library, and Student Administration & Services. In the case where a particular sales/service activity involves the resources of, or results in administrative burden/cost to, Sponsored Project Administration, Library or Student Services, the affected components should not be excluded.

The activities must, at minimum, charge non-UC users the standard overhead cost recovery rates. The standard rates are for:

- Campus - If a sales/service activity is located in campus space, the campus differential rate will be added to sales to the general public.

- Campus - If a sales/service activity is located in space that is not owned or maintained by UC, an off-campus differential rate will be added to sales to the general public.

- Ship Use - If a sales service activity is affiliated with the ship-use operation, with no space costs and all departmental support costs factored into the charge rate, a ship use differential rate will be added to sales to the general public.

Distribution of overhead cost recovery

In most cases, the Differential Income is to be distributed in two parts:

(1) Central administration and (2) departmental support or to the Vice Chancellor responsible for the activity. When an activity has obtained approval from its Vice Chancellor to charge the minimum overhead rate for non-UC sales, the central administration portion must be remitted annually.

A minimum of 11% assessed on revenues for overhead recovery (Differential Income) must be included in all rates charged to external customers for on-campus activities. A minimum of 5% assessed on revenues for overhead recovery (Differential Income) must be included in all rates charged to external customers for off-campus and Ship-Use activities.

Campus will assess units on this minimum for all rates charged to external customers. Recovery above these percentages will be retained by generating department. Each Vice Chancellor area may also require a minimum Differential Income portion to be remitted to the Vice Chancellor responsible for the activity. Consult your Vice Chancellor’s office for more information.

Administrative Overhead Rates (ASSA)

- Auxiliary Administrative OH Recovery Rate: 7% [on current year Revenues]

- Educational/Academics OH Recovery Rate: 3.4% [on current year Revenues]

- Primary Health Care* Administrative OH Recovery Rate: .7% [on current year Revenues]

*Primary Health Care consists of the Medical Center and the Clinical Practice

For more information on if an activity is subject to ASSA, please contact Recharge@ucsd.edu.

Overhead Cost Recovery - Differential Income (DI) Waivers

Generally, waivers requests are approved for the cognizant Vice Chancellor’s (Departmental Support) portion only. The central administration portion must still be collected and remitted.

BFS must be notified of all DI Waiver Request approvals.

Overhead Cost Recovery - Differential Income (DI) Exceptions to Policy

For new activities, the classification process will determine the appropriate overhead rate, if any. If an external entity prohibits payments for overhead, the activity must produce documentation that demonstrates this exemption.

To request a DI Exception to Policy, please complete the DI Exception Request and forward to the cognizant VC Office for review and endorsement. The VC Office will forward their endorsement to BFS for final approval.

Overhead Cost Recovery - Differential Income (DI) Recovery Use

Funds representing Differential Income, which are distributed to an activity's Differential Income reserve, cannot be used to fund operating costs of the activity; however, these funds may be used to fund non-operating costs, such as equipment and capital improvements of the activity. With the approval of the cognizant Department Chair or Administrative Unit Head, such funds also may be used for operating costs of the department or unit, other than those of the activity itself. Although Differential Income funds can’t be used to fund the operating costs of the activity, they can be used to subsidize the UC users of the activity.

Recommended uses of DI recovery;

- Cover unallowable expenses

- Equipment purchases

- Expansion of operations