Oracle Fixed Assets FAQ

Last Updated: December 19, 2025 12:01:56 PM PST

Give feedback

Expand section

What is the Oracle Fixed Asset Module?

The Fixed Assets module is an existing module within Oracle Financials Cloud that is used to track and maintain inventorial equipment and capital assets. This implementation focuses on improving and streamlining business processes surrounding capitalization, depreciation, other accounting transactions, and financial reporting required for Campus and Health Systems.

What is a Fixed Asset?

A Fixed Asset is a tangible piece of property or equipment with a minimum acquisition cost, has a useful life of more than one year, is recorded at the cost it was purchased, and depreciated throughout its useful life. Fixed Assets can be categorized into one of the following types:

- Inventorial Equipment: A piece of equipment that has a total acquisition cost of $5,000 or more (including tax (sales, use, etc.), shipping, training, calibration, and any installation costs).

- Intangibles: An asset of a non-financial nature and lacking physical substance with an acquisition value of $5,000 or more. Intangibles are purchased or licensed, acquired through non-exchange transactions, or internally generated.

- Library Collections: General library materials or rare library books and special collections ascertained through a purchase, gifts and exchanges, or withdrawals.

- Plant/Property: Land and/or buildings and all related improvements and renovations of $35,000 or more.

- Software: Computer programs and associated documentation and data with a total acquisition cost of $5,000 or more.

When will the Oracle Fixed Assets Module go live?

The Fixed Assets module launched in July 2023.

How will CAMS be impacted by Oracle Fixed Assets?

CAMS (Campus Asset Management System) will remain UC San Diego’s system for the physical inventory of equipment. Newly acquired inventorial assets will be processed in the Oracle Fixed Asset Module, and an Asset Number will be sent to CAMS once reviewed and fully paid. If a change is made to an asset in CAMS such as updating the room, custodian, transferring to a different Department/Financial Unit, etc., that change will be sent back to Oracle Fixed Assets.

Will existing inventorial equipment in CAMS be converted into Oracle Fixed Assets?

Active, pending, and in-transfer assets that are in CAMS have been converted to Oracle Fixed Assets. Any Inactive assets will not be converted unless they are located and reactivated in CAMS.

Will the current UCID Number be used in Oracle Fixed Assets?

All existing inventorial equipment in CAMS has been converted using their current 9-digit UCID number. All new inventorial equipment capitalized after July 1, 2023, has obtained a system-generated, 10-digit Oracle Asset Number.

What access will be available for Oracle Fixed Assets vs. CAMS?

All existing access in CAMS will stay the same, and users will continue to use CAMS for any updates that need to be made to assets. Department users will only be able to view assets and their related information in Oracle through the Fixed Assets module and will not be able to submit changes in Oracle.

Users that have any existing inquiry and reporting access in Oracle will be granted the new FA Inquiry and Reporting role without the need to submit any new SNOW tickets. Learn more information regarding FA and other Oracle access.

Does Oracle Fixed Assets accounting support any required UC or GASB Accounting Policies?

Yes, all accounting entries generated by the Fixed Assets module are in line with all required policies for both GASB and UCOP.

As UCOP and other UC’s transition to Oracle Fixed Assets, all required reporting will continue to be sent to UCOP according to their required timeline and report specifications.

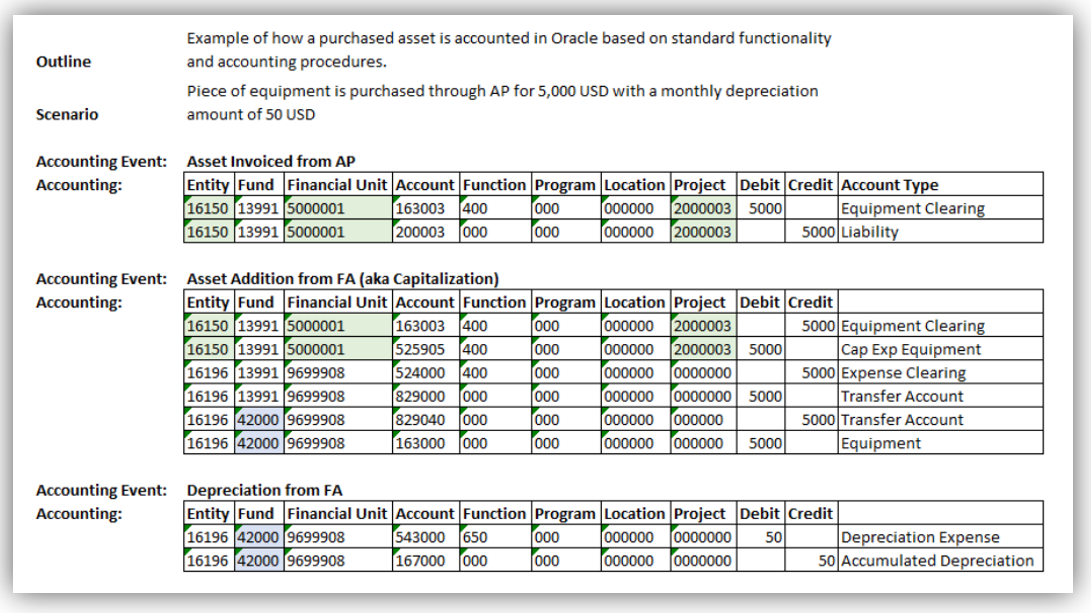

How is an asset accounted for in the General Ledger?

The following is an example of an asset that was purchased for $5,000 that has been capitalized and posted to the General Ledger.

- The assets are purchased from a PO and paid for on an invoice by the purchasing Financial Unit/Project and their desired Fund on an Asset Account.

- The capitalization entry:

- Transfers the value of the asset to an expense on the purchasing Fund/Financial Unit/Project

- Transfers the value of the asset to the 42000 NICA Fund and centralized Financial Unit through a series of transfer lines/accounts

- Any monthly depreciation is posted to the 42000 NICA Fund and centralized Financial Unit

How will the purchase and related accounting of assets impact my Financial Unit and/or Project Budget/Deficit Reporting?

When an asset is purchased, the transaction(s) will be purchased and accounted on a 163XXX asset account. Upon capitalization within the Fixed Assets module, the cost of the asset will be cleared from the 163XXX account it was purchased on and expensed against a 52XXXX expense account.

Once the asset gets expensed, it will roll into the typical expenses and carry forward balances like traditional expenses.

Additional information is available on Asset Accounting.

Once the asset gets expensed, it will roll into the typical expenses and carry forward balances like traditional expenses.

Additional information is available on Asset Accounting.

How is the depreciation of an asset calculated?

Monthly depreciation is calculated based on the value of the asset and its life in years. Example:

- Value of Asset = $10,000

- Life in Years = 10

- Months in a Year = 12

- Monthly Depreciation = $10,000 / (10 * 12) = $83.33

What reports will be available at go live for assets?

A new Fixed Assets Dashboard is being created with the following reports included at or shortly after going live:

- Asset Inventory Report: Identify assets by department, custodian, or location and track custodial responsibility

- Asset Purchasing Report: Review purchase-related details, including invoices and purchase orders linked to assets, and gain information into purchasing history.

- Asset Depreciation Report: Review monthly depreciation calculations and accumulated depreciation by asset.

- Asset Retirements and Disposals Report: Identify assets that have been disposed of by department, custodian, location, etc.

Existing reports that are currently used within CAMS or other tools will continue to be available in their current state.

Who is the owner of the assets purchased within the University?

When doing business on behalf of the university, all purchases made with regard to assets are therefore owned by the university.

The Financial Unit listed as the Custody Code on the asset indicates is responsible for the physical tracking and management of the asset. The custodianship of an asset can be transferred from one Financial Unit to another through the transfer request in CAMS, which will also update the Custody Code listed on the asset in FA.

How is inventorial equipment purchased?

Inventorial equipment purchased by the university will continue to go through the requisition and purchase order process. All equipment purchased through a requisition should use one of the following Expenditure Types/Account Codes when providing the POETAF information on the requisition, including any lines for related costs (Tax, Installation, Shipping, Training, affixed components, etc.):

- 163001 - Equipment In Process (for Fabrications Only)

- 163003 - Inventorial Equipment

What if inventorial equipment was purchased on the incorrect project and/or funding source?

The FA Project Team is currently evaluating configuration and BI options to

- Identify how often cost transfers occur on assets

- Identify cost transfers that occur on assets to update the asset record in Fixed Assets with the new Fund/Financial Unit/Project the purchase was transferred to

- Non Salary Cost Transfer Request through Services and Support

- Custom Process/Integration/Reporting Solution

What if inventorial equipment was purchased on the incorrect account code/expenditure type?

Continue to request a Non Salary Cost Transfer Request through Services and Support. When providing a reason, select:

“The expense or expenditure type on a PO, non-PO, or Concur transaction posted to an incorrect expenditure type/account”

Then download, complete, and attach the Posted Payable Cost Transfer Request Excel template when submitting.

An expenditure type correction may be needed when:

- A cost related to an asset was NOT purchased on an asset clearing/CIP account

- Example: Shipping for a piece of equipment was purchased on 539100 – Transportation and Shipping Srvcs but should have been purchased on 163003 – Inventorial Equipment.

- A non-asset was purchased on an asset clearing/CIP account

- Example: Lab Supplies were purchased on 163003 – Inventorial Equipment but should have been purchased on 522401 – Lab Supplies.

How and when is inventorial equipment capitalized?

Once an asset is reviewed and confirmed by the Equipment Management (EQM) Team in Oracle Fixed Assets, the asset record is created. Once the asset record is created, the Fixed Assets module will capitalize the asset and generate the corresponding accounting entries.

Depending on the complexity of the asset (i.e., multiple lines, multiple quantities, split funded, etc.), the more time it will require the EQM team to capitalize the asset within the Fixed Assets module. This review process can sometimes take days or even a couple of weeks to ensure the accuracy of the cost and components of the asset.

How is inventorial equipment added that was not purchased on a PO (i.e. transferred from another UC, transferred from an external agency, gifted to the university, etc.)?

Inventorial equipment that was not purchased through procurement will be manually entered into FA by the central EQM team, and then sent and added to CAMS. More information about the various acquisition methods can be found on Blink:

How is an accessory added to an existing piece of inventorial equipment?

Accessories to inventorial equipment should continue to be purchased through Procurement, with reference to the existing Asset/UCID number in the Asset Number field on the requisition under Additional Information.

How is inventorial equipment transferred to a different Financial Unit, Location, or Custodian/Employee?

How is inventorial equipment disposed of?

Disposals for inventorial equipment should continue to be processed through CAMS.

Find answers, request services, or get help from our team at the UC San Diego Services & Support portal or call the Finance Help Line at (858) 246-4237.