Chapter 2.2: Sponsored Project

Sponsored Project

Sponsored projects represent an activity that is sponsored, or funded by an external organization, such as a federal, state, private organization, or agency in which a formal written agreement, i.e., a grant, cooperative agreement, or contract is entered into between the University of California, San Diego and the sponsor.

Sponsored projects class category includes Research, PI Initiated Clinical Trial, and Sponsor Initiated Clinical Trial. The research category is for traditional grants for research projects. These projects are created automatically through an integration with Kuali Research (KR) and the award is set up by Sponsored Projects Finance (SPF). These projects have Awards and Funding Sources established. The Award number is always the base KR Award Number, and the External Funding Source is always the KR Sponsor Name.

Project transaction controls are available for Sponsored Projects. Transaction controls are used to specify the type of transactions that are non-chargeable for the project and tasks. The list of unallowable expenditure types (aka E codes in the legacy system) can be viewed by navigating to Projects, search for the desired project, from the menu click Manage Project Financial Settings, and select Transaction Controls or through reporting: bah.ucsd.edu>Department Exceptions Panorama.

Additional Training on Awards can be found through Blink FIS Training and on the STaRT Tool.

2.2.1: Awards

Awards represent a pool of money that projects may draw upon. One award may be associated with multiple projects, and each project will only be associated with one award. Most awards will be automatically generated through an integration with KR. By default, awards are set up with one project and one task. Additional projects or tasks may be created for the following reasons:

| Award | Project | Task |

|---|---|---|

|

|

|

Fund Managers can request additional projects or tasks through Services & Support. It is recommended to limit the number of tasks to the above reasons.

Awards and Contracts

In the Oracle Financial Cloud system, The Grants Management Module manages Award data. The Contract Module manages Contracts. All Awards are Contracts, but not all Contracts are Awards. Contracts is the basis for how Oracle designed a Grants Management solution. However, Contracts can be used for non-sponsored projects not associated with a research award, such as a service agreement (See General Projects section of this guide). The OFC Awards module is an extension of the Contract Module, and when a new Award is created via the KR integration, OFC is creating a special type of Contract with additional fields behind the scenes. This is why the Award Number on the Miscellaneous Cost Import file (“MCI” - PPM FBDI file for cost import) and similar interfaces is called the “Contract Number”, and certain screens will say “Submit Contract” instead of “Submit Award.”

2.2.1.2 Award Funding

Award funding is based on the Notice of Award from the sponsor as entered in Kuali Research. Funding is then allocated to the project(s). Budgets are then created at the project/task level. Project budgets must be within the funded amount as this is an Oracle control.

For awards that are at risk of not receiving the full awarded amount, such as clinical trials, the funding is at the ceiling that the sponsor allows and then the budget is initially created by the central office at the same ceiling amount. Departments can edit the budget (create a new version) to a lower amount if desired for PI reporting.

Additional information in Awards Training.

2.2.2: Billing

The Sponsored Project Accounts Receivable and Cash Management (SPARCM) system is used for sponsored project billing. It is designed to create invoices and manage Financial Expense Reports (FERs) and Sponsor Required Financial Reporting. It serves as a repository for all invoices created during the life of the award.

SPARCM allows departments to:

- View invoices submitted to sponsors.

- Create Industry Sponsored Clinical Trial invoices.

- Track withholding amounts for final invoices.

- Submit electronic Financial Expense Report (FER) to SPF.

- Track upcoming FERs due.

Billing frequency, terms (net 30 preferred), and billing contract information must be indicated in any agreements for services and/or goods between UC San Diego and external organizations. The university’s common billing address must be used to ensure monies are collected centrally to be properly applied and reconciled to open receivables. Each department incurs the financial risk and assumes the liability for all unpaid past due balances. This includes resolving deficits incurred because of any uncollectible balances leading to a write-off. The department in consultation with the Accounts Receivable office must continually assess the ongoing financial risk to the university of continuing to provide products or services on behalf of any delinquent customer. Late fees may be assessed and collected by the Accounts Receivable office.

SPARCM is integrated with the Contracts Management billing module in Oracle Financials Cloud. Billing events are automatically created when invoices in SPARCM have a posted status. Sponsored activities are secured and paid in two ways: cost reimbursable or fixed price.

Letter of Credit awards are billed through Oracle (not SPARCM) using native Oracle PPM Billing functionality.

2.2.2.1 Cost Reimbursable

For activities that are cost reimbursable, the University fronts the expenses, and the sponsor is then invoiced accordingly for allowable and reasonable expenses, in accordance with the terms of the contract. However, the costs cannot exceed the award amount. Any excess of spending over the award amount is the responsibility of the department and must be cleared within 120 days of the award end date. Review the Sponsored Research Deficit Procedures for more information.

2.2.2.2 Fixed Price

If the grant or contract is fixed price, the activity is negotiated at a pre-set amount, regardless of actual costs. If the costs incurred are more than the award amount, the cost overrun will be covered by the corresponding PI/department. Actual project costs are not reported to the sponsor. The sponsor is invoiced based on a pre-determined schedule in accordance with the terms of the contract. If there is a residual balance (income exceeds expenditures), the department may be eligible to retain these funds. Depending on the invoicing terms, a final invoice may be necessary before closing the award account. See Fixed Price Policy and Closeout process.

2.2.3: Sponsored Project Revenue Recognition

Sponsored Project revenue is based on when the invoice is billed, regardless of billing type.

Sponsored Projects Revenue is accounted at the fund and financial unit-not with the Project segment in the COA string. This is because the balance segments are fund/financial unit. This will continue to be reviewed with the SPARCM replacement project, currently slated to begin in December 2022.

2.2.4: Overhead Assessment – Indirect Costs - Burden

Indirect Costs (IDC) are charged to Sponsored Projects Awards based on the Federally Negotiated Rate or agreement with the sponsor. More information can be found here: https://blink.ucsd.edu/research/preparing-proposals/idc-facts.html

IDC is referred to as Burden in Oracle. Burden Structures are set up to include appropriate expenditure types that are subject to IDC. The Burden Schedule then applies the assessment at a set rate and creates the costs daily. Previously, Burden was calculated and assessed daily and summarized by costs of the same Expenditure Item date and expenditure organization. As of 11/5/21, Burden is calculated and assessed daily on a per transaction basis.

Indirect Cost Recovery (ICR) is the campus recovery of this IDC that the Campus Budget Office manages and distributes to campus to support the research function.

Additional information on IDC can be found here: Understanding Burden Schedules

2.2.4.1: PI-Initiated vs Industry-Initiated Clinical Trials

A study is considered a clinical trial when it contemplates the controlled, clinical testing in human subjects of investigational new drugs, devices, treatments, diagnostics, or comparisons of approved drugs, devices, treatments, or diagnostics to assess their safety, efficacy, benefits, costs, adverse reactions, and/or outcomes. Studies may be conducted under an industry-developed protocol or a principal investigator-developed protocol.

| PI-Initiated | Industry-Initiated | |

|---|---|---|

|

Responsible Pre-Award Office |

Office of Contracts and Grant Administration (OCGA) |

Office of Clinical Trials Administration (OCTA) |

|

Protocol |

|

|

|

Indirect Cost (IDC) |

|

30% IDC rate assessed on revenue. |

|

Funding Source |

May be funded by a for-profit, non-profit, state, or federal agency. |

A for-profit entity must be the source of funding. |

2.2.4.2: Understand Burden Cost vs. Raw Costs

Raw costs and Burdened costs can be found in Projects > Costs > Manage Project Costs

- Raw Cost in Provider Ledger Currency = Raw Cost in Project Currency = Raw Cost in Transaction Currency

- Burdened Cost in Provider Ledger Currency = Burdened Cost in Project Currency = Burdened Cost in Transaction Currency

It is recommended to use burdened costs in reconciling projects because it shows the burden or indirect cost charged on the project using expenditure type 538000 - FandA (IDC) – Expense.

Raw cost is the direct cost. IDC/Burden is calculated as a separate cost and shows in the burdened cost column. IDC is not calculated with the single direct cost line item because the raw cost and burdened cost would be two different amounts on the direct costs.

More information: PPM Raw Costs vs Burden Costs

2.2.5: Budget

The Project Budget must be completed and baselined in order for costs to be incurred for all types of awards. Fund managers or department designee receive an email notification when the award is ready for budget creation. They are responsible for setting-up the initial budget as well as future budget modifications in the Awards module. Budget modifications that require prior approval from the agency will need to go through the appropriate contracts’ office, OCGA or OCTA, and be reflected in KR.

Budget creation defaults as follows when Fund Manager fails to complete the budget:

- Resource Category: Operating Expenses = Total Direct Cost

- Resource Category: Indirect Cost = Total Indirect Cost

SPF Award Accountants review and approve budgets, process re-budgeting between projects and restrictions to budget resources for NIH awards where carry over requires prior approval, and any other financial restrictions per the Notice of Award. During the award close out, the fund manager or the award accountant is able to process a deallocation from the project budget to match final invoice or final report. For more information, see How to Manage Sponsored Project Budgets in OFC PPM.

Sponsored project budgets are based on burdened costs. It is recommended to hide/ignore the raw cost column when managing project budgets. Also note that budget versions in OFC are cumulative, therefore when modifying budgets, previous year allocations must be included, otherwise, there could be unbudgeted amounts on the project.

2.2.6: How to Check Award Budget, Costs, and Balances

Generally, Sponsored Projects are managed based on the Budget vs. actuals. The Funding generally matches the Budget. There are cases, such as clinical trials where it might be prudent to set the budget at a lower amount than the funding to control the available balance on PI reports.

The Revenue and Cash Received are managed outside of the Award space and are important to be aware of but is generally managed by Sponsored Projects Finance (SPF). To see the revenue on an award, please use the Cumulative Research Report and to see the outstanding AR, please see the Sponsored Projects AR Aging report.

Budgets, costs and balances can be viewed using the following screens:

- Awards> Manage Awards: view Budgets, Inception to Date Actual Expenses, Total Commitments, and Balances.

- Projects> Costs> Manage Project Costs: view details of the actual costs on projects and awards.

- Projects> Costs> Manage Project Commitments: view all Committed Costs

- Projects Panorama report on reports.ucsd.edu

To learn more about reviewing budget, costs and balances, see How to Check Award Balances/Expenses.

Additional reporting available at reports.ucsd.edu.

2.2.7: Unique Sponsored Projects Processes

This is not all-encompassing for processing and managing every aspect of sponsored projects, but is intended to discuss unique, not as common processes.

2.2.7.1: Subawards/Subcontracts

Proposals may include work to be done by one or more other institutions. In this case, the other participating institutions become subrecipients under the University of California, San Diego’s prime award. PIs/departments must address specific questions regarding subcontractor suitability, selection and potential conflicts of interest prior to the establishment of a subcontract.

Subcontracts are initiated through OCGA and managed through KR. Approved subcontract invoices are integrated from KR to OFC AP and PPM to pay the subcontractor and reflect the expense.

To track regular and intercampus subcontracts/subsites without creating a task for each, follow steps from the How To Manage Subcontracts/Subawards in OFC PPM KBA in Services & Support.

Subawards are entered as a commitment in Oracle to reflect the obligation to pay the subaward. See Commitments in OFC for more information.

2.2.7.2: Fabrications

Dedicated projects are created for Fabrication costs and are set with a 0% IDC rate. Any appropriate expenditure type can be charged to the task. If a fabrication is cancelled, please transfer those costs to the applicable project/tasks(s) and burden would then be assessed.

See section 2.1.2 above for additional information on the process.

2.2.7.3: Cost Sharing

In cost sharing, the university commits resources to projects/research awards that are funded by external sources, usually in the form of contracts or grants. UCSD’s cost sharing resources can include staff time, supplies and materials costs, equipment costs, or commitments from outside partner organizations (3rd party cost sharing).

The award accountant designates one or multiple internal funding sources for cost sharing commitment in Funding Sources panel within the Financial tab of the Award space. The department is responsible for identifying and providing to SPF the source(s) the department will be using. If the desired internal funding source is not available, SPF submits a Services & Support ticket to Information Technology Services (ITS) to create the funding source based on the fund provided.

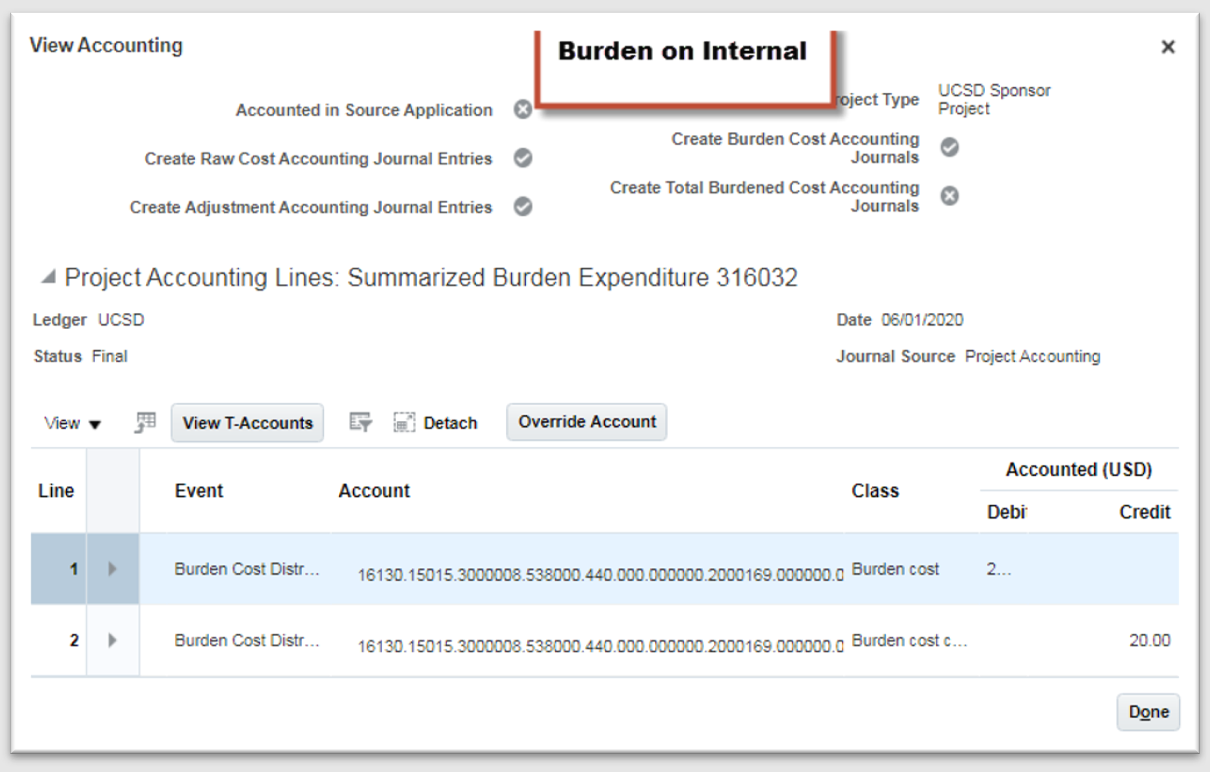

2.2.7.3.1: Cost Sharing Projects

An additional project will need to be set-up on the award to track the cost sharing transactions. If burden is required on cost share transactions, the appropriate burden schedule will apply and accounting nets to zero based on the funding source used in the POETAF. For the first 2 years, burden schedules with prefix “INT” will need to be assigned to the cost share task in the Project Burden Override screen. It is important to know that Burden or Indirect costs assessed will zero out accounting wise using internal burden schedules. At go live, guidance was to have a separate task. This process still works and awards were not reconverted, but separate projects provide more visibility and control for management to departments.

2.2.7.3.2: Funding Allocation and Budget on Cost Sharing

Sponsored Projects Finance (SPF) will allocate the funding from the identified source. Budget can then be allocated just like any other sponsored budget allocation. See 2.2.5 Budget section for more information.

2.2.7.3.3: Cost Sharing Costs

| Type of Costs | |

|---|---|

|

Direct Cost |

Cost share commitments identified in the proposal or as stated in the Notice of Award (NOA) will need to be identified up front or at the beginning of the award period and charged to the cost sharing task/project created on the award. Or, cost transfers will need to be done after the fact. |

|

Converted Cost |

Task 0 internal funding source(s) was created for all converted cost share tagged in the legacy cost sharing system. If the source fund was in the cost sharing system, that specific internal funding source was converted to the award. Otherwise, the generic “internal” was used. Departments will need to confirm/provide the specific internal funding source to the award accountants before spending can occur on Task 0. |

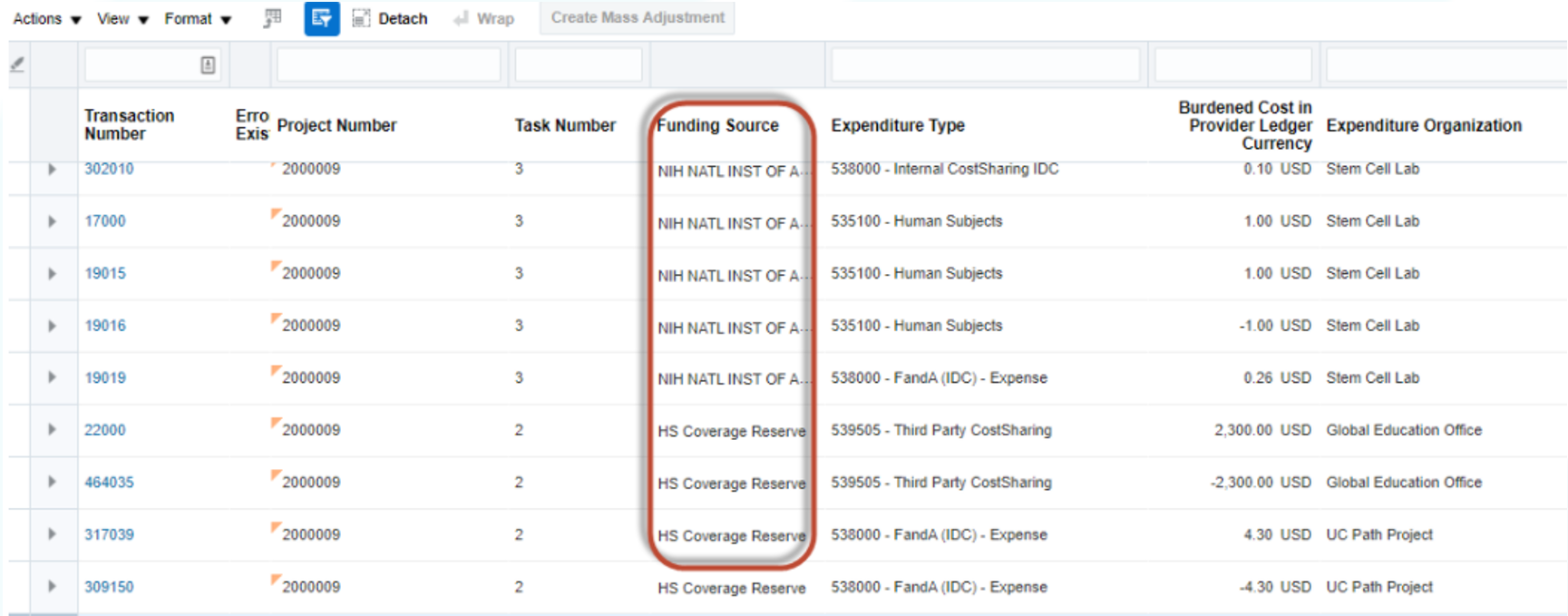

2.2.7.3.4: Non UCSD or 3rd Party Cost Sharing

Third party cost sharing is when UC San Diego agrees to cost-share expenses that are incurred through an outside entity. During award set-up, the award accountant will designate an internal funding source called 3rd Party Cost Share for cost sharing commitment in the Funding Sources panel within the Financial tab.

When non-UCSD entities are involved in a project, the department will need to submit a Services & Support ticket to provide evidence of their cost sharing expenditures. The evidence will be uploaded to the award in Oracle, and the award accountant will create a new task and manually add the cost using the expenditure type 539505-3rd Party Cost Sharing. The cost will zero out when posting to the ledger.

2.2.7.3.5: How to Review Cost Share Costs and Accounting

To review cost share costs:

- Navigate to Awards

- Click on Manage Awards

- Search for Project/Award Number

- Click on the Award Number and drill down to the desired Project with Cost Sharing

- Select Manage Project Costs to see all the costs on the project.

The search can be filtered for the internal funding source or view costs based on the cost sharing source.

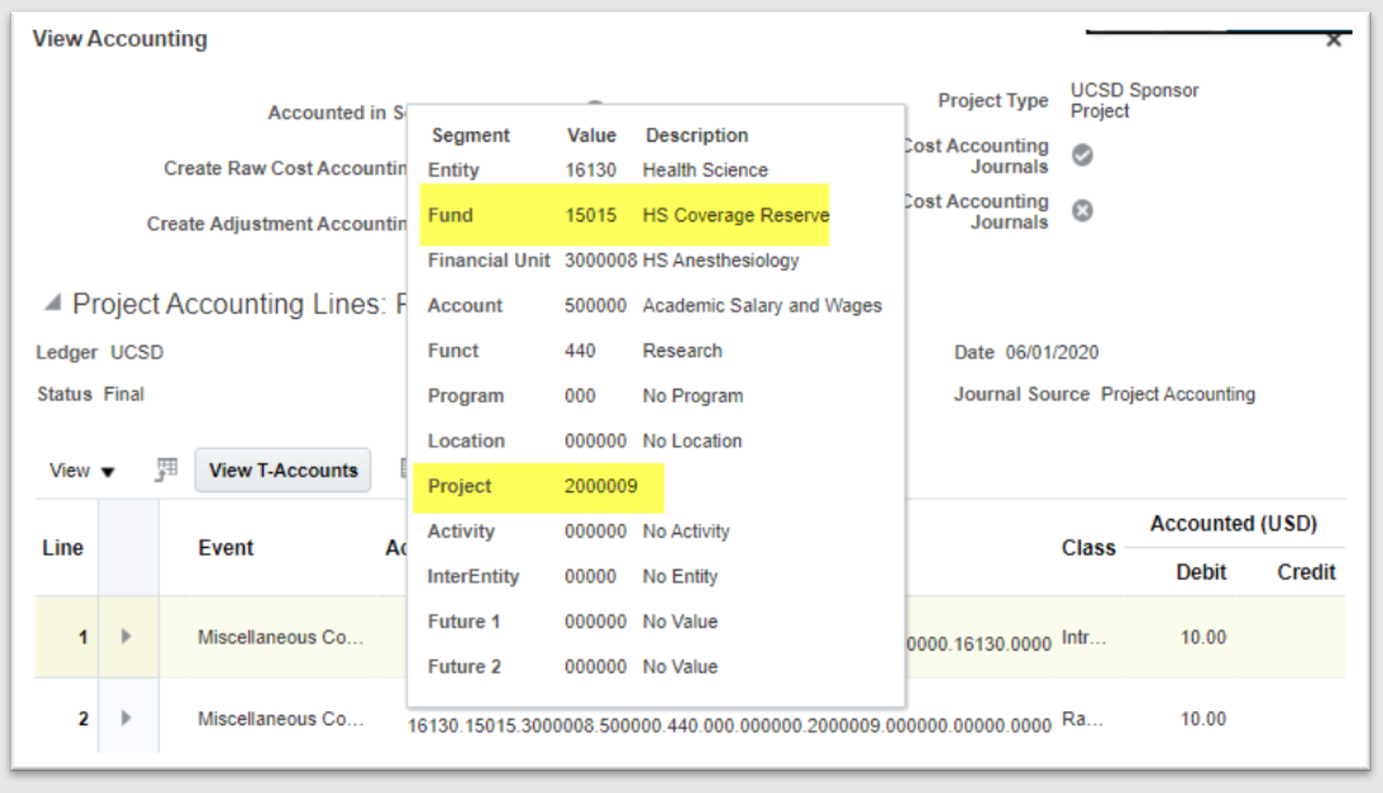

To review accounting:

- Highlight the desired cost, click on Actions

- Select Accounting

- Click on View Accounting

This example shows the Fund for the cost is the internal funding source charged to the Project Owning Organization’s Financial Unit.

2.2.7.3.6: Cost Sharing FAQs

How does my GL reconcile with my cost-sharing?

Your expenses that are charged to your cost-sharing will be charged with the SP project number in the chart string, but a different fund from the externally sponsored portion. If you need to move resources in the GL to “zero out” the fund/FinU, process a journal.

Example: NSF award with cost sharing being met by SOFI

Expense to the NSF portion: 16110.20000.1000020.522401.440.000.000000.1234567.000000.00000.

Expense to the SOFI portion: 16110.13991.1000020.522401.440.000.000000.1234567.000000.00000.

SOFI resource: 16110.13991.1000020.774009.000.000.000000.2345678.000000.00000.

Optional Journal in GL

CR 16110.13991.1000020.774009.440.000.000000.1234567.000000.00000.

DR 16110.13991.1000020.774009.000.000.000000.2345678.000000.00000

What if my Cost-sharing is being met by another Department?

There are two options depending on the accounting requirements.

- Create new project with that other department project owning organization. When you charge costs to this new project, the expenses will post to this other dept FinU.

- Other dept transfers the resources to your FinU, same project number, different fund. Create a separate task to track this separately, if desired.

What chart string do I enter for UCPath?

Use the same chart string that you would for your sponsored project, but make sure to enter the FUNDING SOURCE that is appropriate for your cost-sharing. This will ensure that the same controls for your sponsored project will be applicable to the cost-sharing commitment. The accounting is derived from PPM when the payroll is posted, so the appropriate cost-sharing fund as setup by your internal funding source will be charged.

How do I record cost-sharing that is being met by another sponsored research award?

This is a very rare situation, but if you do have this, please follow the instructions for 3rd party cost-sharing and make sure that your documentation is very clear that it is approved and that the costs are not being cost-shared on any other award.

See https://ucsdcloud.sharepoint.com/sites/STaRT/ofcppm/SitePages/OFC-PPM-Department-Guide-to-Managing-Cost-Sharing.aspx For more information

2.2.7.4: Program Income

2.2.7.4.1: Definition

- Gross income earned by the grantee that is directly generated by a supported activity or earned as a result of the award.

- Includes, but is not limited to, income from fees for services performed, and any registration or other fees paid by conference participants or sponsors.

2.2.7.4.2: Process

- Unless stated otherwise in the terms of the award, program income received during the period of the grant is retained by the grantee and added to the funds committed to the project and used to further project objectives.

- Record program income on a separate task with internal funding source “Program Income” P12000.

- Assign “No IDC 0.0” to the program income task.

- Income will be posted as miscellaneous cash receipt in the Manage Project Cost screen in PPM under expenditure type “405401 - Program Income on Sponsored Research”.

- This will automatically post as a negative cost when the Project, Task and Funding Sources is entered in the Receipts module in Oracle.

- Record Costs on the separate task setup for program income.

- The F in POETAF is Funding Source number P120000, Funding Source Name: Program Income.

- Expenses and income earned must be included in the financial report when required by the agencies.

- The process for billing to receive the program income is still being determined.

2.2.8: Sponsored Research Dates

Awards have many dates, all of which control the ability to charge to awards.

2.2.8.1: Expenditure Item vs. Creation Date vs Accounted Date

- Expenditure Item (IE) date: date transaction incurred (must be within project period).

- Creation date: date transaction posted in PPM.

- Accounting Date: In the Manage Project Costs search screen, the accounting period is the “most recently updated” accounting period. This is not always equal to the original accounting period that the cost was created and accounted in.

For example, a lab supply is purchased on 3/1/21, but the invoice is paid to the vendor on 4/1/21. The EI date is 3/1/21 and the creation date is 4/1/21.

2.2.8.2: Pre-Award - Spending on Federal and other sponsored Awards

Pre-award costs are those incurred prior to the effective date (usually 90 days) of the Federal award directly pursuant to the negotiation and in anticipation of the Federal award where such costs are necessary for efficient and timely performance of the scope of work. Such costs are allowable only to the extent that they would have been allowable if incurred after the date of the Federal award and only with the written approval of the Federal awarding agency.

Specify the pre-award date to track expenditures incurred before the award is formally received in OFC PPM Awards space. The Project dates will then be in line with the pre-award date and so costs with EI date that is within the Pre-Award Period will post to the project even though the Award start date is later than the project start date.

The Pre-Award cost date can also be utilized for those awards that have approved advanced spending via OCGA. This advanced spending approval would flow from KR with documentation of advanced spending without official Notice of Award (NOA) from agency.

2.2.8.3: Project and Award End Dates

Project End Date: Date project ends

Award End Date: Date Award ends, this is derived from the CONTRACT end date in the Contract Module

Generally, the Project End Date=Award End Date. This can be different if there are multiple projects on the same award.

Oracle functionality (not a configuration) is such that:

- EI Date must be within project end date, regardless of accounting posting date.

- Budget Period dates, regardless of accounting posting date. Budget periods are defined on the NOA and allows for budgeting at period and controls carryforward spending. Converted awards all have a single budget period.

- Control budget dates: these are the dates of the GL control budget set by the baselined Award Project budget.

- Sponsored Projects expenses are allowable if they are incurred during the award.

- Contract (Award) dates, regardless of accounting posting date.

- Project End Dates cannot be backdated once sent.

- Budget Period Dates cannot be backdated once sent (Oracle functionality and is a highly rated enhancement request from the Grants community)

- Award End Date will also stop transactions from posting, but we are able to manually adjust the end date to a future or past date.

- Contracts drive billing controls (dates and dollars)

- Close Date: This is set by SPF and will generally be 30 days past the award end date. This will allow costs to post as long as the EI date is within the other dates outlined above.

In legacy IFIS, if costs posted to the ledger after the award end date, departments had to justify they were incurred during the time of the award. In Oracle, the departments need to provide the correct EI Date, which is a system-driven control for Sponsored Research. Expenses must be within all of the above dates to post as a project cost in PPM.

To check the various dates on your award, please use the Award Projects Dates Report.