Oracle Reporting Hierarchies

Last Updated: November 22, 2023 11:17:12 AM PST

Give feedback

This article provides detailed information on the Oracle Managerial Reporting and Standard hierarchies and how they are used for reporting purposes.

Critical Concepts

- While there are other hierarchies stored in the Oracle database used for processing and posting, these guidelines are focused on those hierarchies created for reporting purposes

- The Oracle Standard hierarchies support external statutory reporting requirements

- The Oracle Managerial Reporting hierarchies support internal financial management reporting

- The Managerial Reporting Account hierarchy includes a one single balance sheet account, Account 300000, Net Position/Fund Balance and temporarily added Level 16000B Capital Assets accounts until the Fixed Assets module is fully implemented

FAQs

Q: What is a hierarchy and what are some examples?

A:

- A hierarchy creates relationships between database items for reporting and processing purposes

- Hierarchies used for reporting purposes allow end users to drill up to a more general level of detail or drill down to a finer level of detail

- These guidelines focus on the Fund and Account hierarchies

- Examples of Oracle hierarchies commonly used in reporting include:

- Entity hierarchy

- Financial Unit Hierarchy

- Fund Hierarchy

- Account Hierarchy

A: The Standard hierarchies are the default hierarchies defined by UCOP and created in Oracle for General Accounting reporting purposes

- Standard Account hierarchy

- Oracle name value: UCSD_ACCOUNT_T-UCSD_ACCOUNT_T_V1

- Standard Fund hierarchy

- Oracle name value: UCSD_FUND_T-UCSD_FUND_T_V1

A:

- Additional hierarchies rearrange the members of the standard hierarchies to meet different management information needs, allowing for flexible reporting

- UC San Diego-Campus has two additional hierarchies for reporting purposes, one for the Account hierarchy and one for the Fund hierarchy

- These are referred to as:

- Managerial Reporting Account hierarchy

- Oracle name value: UCSD_ACT_BUDG_ALTH_T-UCSD_ACT_BUDG_ALTH_T_V1

- Managerial Reporting Fund hierarchy

- Oracle name value: UCSD_FND_BUDG_ALTH_T-UCSD_FND_BUDG_ALTH_T_V1

- Managerial Reporting Account hierarchy

A:

- Financial reporting typically serves two diverse stakeholder groups:

- External statutory reporting requirements

- Internal financial management reporting and performance monitoring

- The Standard hierarchies support external statutory reporting requirements

- The Managerial Reporting hierarchies support internal financial management reporting:

- Revenues/Resources and Expenses are grouped into categories that support financial planning, analysis and decision making, similar to sub accounts in IFIS

- Funds are grouped into Core/Non-Core categories which is an essential component for campus resource allocations, such as the Core-Funded portion of the campus budget

A:

- If the report follows external statutory financial reporting requirement: Standard Account hierarchy

- If the report measures financial performance of a campus unit or if Recharges and Allocations are included as resources: Managerial Reporting Account hierarchy

- If the report includes asset and liability accounts: Standard Account hierarchy

- If the report segregates funds by Unrestricted, Agency, Net Investment in Capital, Restricted Expendable, Restricted Unexpendable: Standard Fund hierarchy

- If the report segregates funds into Core/Non-Core categories: Managerial Reporting Fund hierarchy

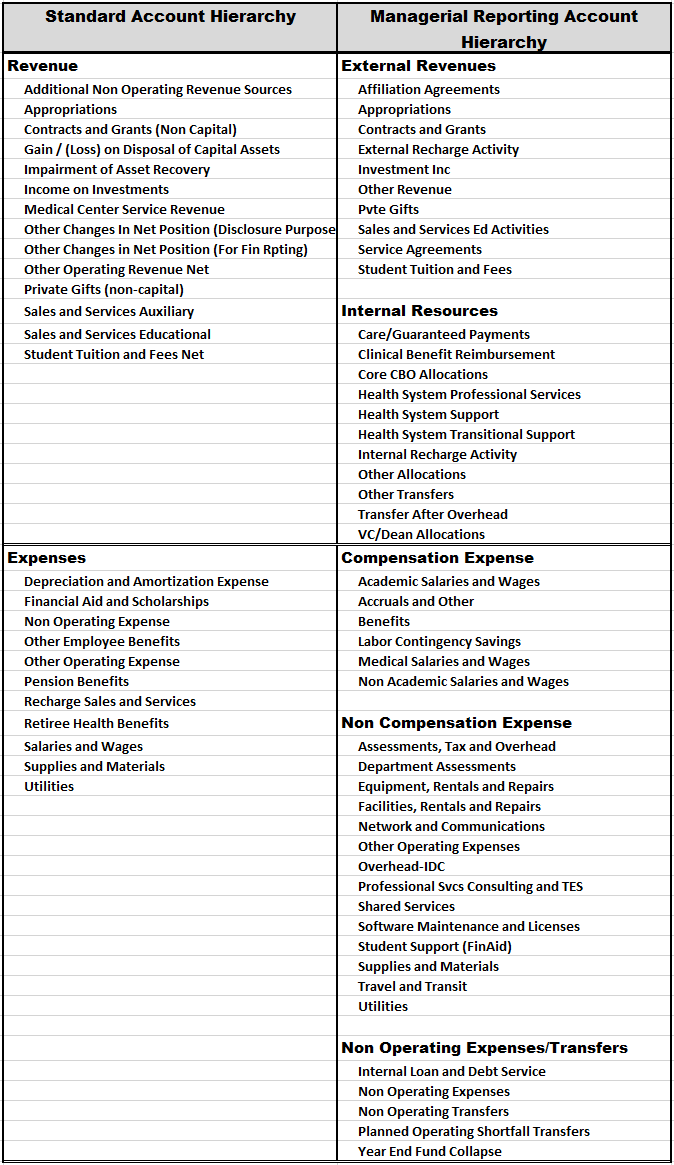

Key Differences Between the Standard Account Hierarchy vs Managerial Reporting Account Hierarchy

- Managerial Reporting hierarchy places some 7x and 8x Accounts such as Recharges and Allocations into the Resources category

- Standard hierarchy places these Accounts in the Expenses category

- Managerial Reporting hierarchy splits Expenses into three main categories: Compensation, Non-Compensation and Non-Operating Transfers/Expenses

- Standard hierarchy splits Expenses across 11 categories specified in chart below

- Managerial Reporting Expense categories are based on those Expenses managed by a campus unit

- Standard hierarchy Expense categories are based on financial reporting requirements

- An example is Pension Benefits which must be reported on external financial statements but is not a managed Expense by a campus unit and is not called out as a separate category in the Managerial Reporting hierarchy

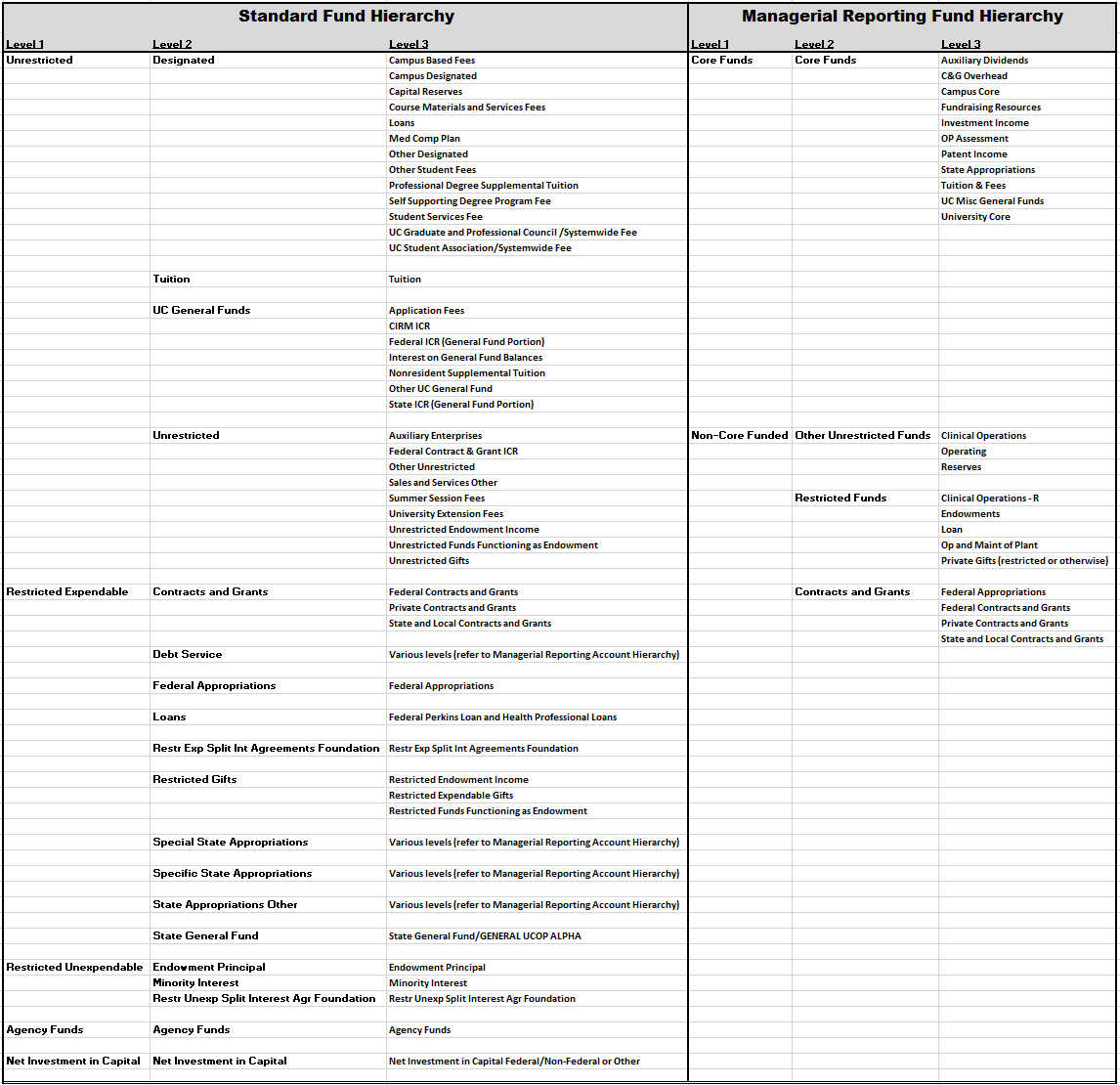

Key Differences Between the Standard Fund Hierarchy vs Managerial Reporting Fund Hierarchy

- Managerial Reporting hierarchy groups Funds into categories required for managerial analysis, such as deficit reporting

- The Managerial Reporting Fund Hierarchy is also used for allocating campus core resources

- Standard hierarchy groups Funds into categories required for external financial statement reporting

- Managerial Reporting hierarchy groups Funds into Core/Non-Core categories; Standard hierarchy does not