Chapter 1: Overview

Overview

Within the Oracle Financials Cloud, transactions are accounted for in the General Ledger (GL) but can be tracked at a more granular level within Oracle Project Portfolio Management (PPM). PPM is a suite of modules (including Awards, Contract Management, Project Financial Management, Project Financial Plan, Project Costs and Commitments) that is designed to track project costs, billing and revenue against project budgets. PPM operates as a subledger that tracks detailed transactions separately and then generates a summary-level entry to record those transactions in the General Ledger (GL). The General Ledger is a summarization of data from all the subledgers that provides a higher-level view of accounting activity with less granular detail than PPM or other subledgers.

In PPM, a project is a primary unit of work that can be broken down into one or more tasks. The project number assigned in PPM matches the seven-digit project number in the chart of accounts project segment, but the two are distinct elements. In the GL, the project segment is part of the Chart of Account. Transactions are done using chart strings via journal entries. In contrast, PPM uses the POETAF string to transact in the PPM subledger. See section 1.5 for further detail.

Elements from the legacy accounting system do not translate exactly into elements of Oracle Financials. Project and index (pre-Oracle) are not equivalent. Task and index are not equivalent. Transactions in PPM do not occur via journal entry, which can only be processed in the GL. To see the detailed information on any transaction, users need to look in the subledgers directly or use reports based on subledger data.

Chapter 1.1: Understanding Subledgers and General Ledger

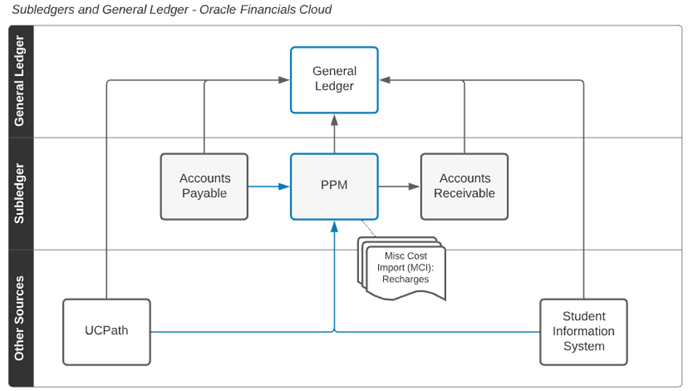

This diagram illustrates the flow of transactions from subledgers into the General Ledger. Accounts Payable and Accounts Receivable can push data directly into the General Ledger, without PPM involvement, or PPM can be an intermediary that collects and/or creates transactions before the data is aggregated to the GL.

This table illustrates how Oracle Projects supports Expenses, Revenue, Resources and PPM Budgets at the project and task levels in PPM:

| Expenses at task | Revenue at Task | Core resources at task | Use PPM Budget (Financial Plan)? | |

|---|---|---|---|---|

| External Revenue | Yes | Yes-with contract | No | Optional at task |

| Core Campus Funding | Yes | N/A | No | Optional at task |

| Mix of core and external revenue | Yes | Yes-with contract | No | Optional at task |

| Activity not through PPM | No | No | No | No |

| Sponsored Projects | Yes | No | No | Yes |

PPM Budgets (Financial Plans) are managed and controlled by departments - not central offices. This process can be useful for planning at the task level and will be in PPM reports in the Budget column.

Chapter 1.2: Reasons to Use PPM

- To track:

- Contracts and Grants Award information, including funding amount, budget, expenses and revenue.

- Traditional projects that have a start and an end date (e.g. Sponsored research, construction, conferences).

- Fabrications.

-

- Long-term efforts that cannot be captured by another segment in the chart of accounts (e.g. Recharge operations, academic courses, groups in the same financial unit).

- Expenditures by task more granularly than required by campus leadership when needed for local level leadership.

- To record short-term and one-time costs (e.g. Faculty startup dispensations, service agreements).

- To view expenses in PPM and support performance monitoring with Budget vs. Actuals and facilitate reporting.

- To further track expenditures at a task level.

Chapter 1.3: Nuances between Budgeting in PPM and Budgeting in EPBCS

PPM functionality allows a budget (financial plan) to be entered at the project and task level in order to monitor variances between expected expenses and actuals. The PPM budget is a distinct concept from the Campus Operating Plan that is developed in the Oracle Enterprise Planning and Budgeting Cloud Service (EPBCS). EPBCS has a separate budget planning and review process that occurs on an annual basis with approval from multiple layers of university management culminating with the Chancellor’s approval.

The approved campus budget results in allocations being distributed to financial units. The PPM budget is a tool that can be used to implement the approved campus budget spending plan and enable reporting at a more granular level than is possible in the GL. There can be instances where the EPBCS budget will not exactly match the financial plan in PPM for valid reasons. The EPBCS budgeting tool was designed to accommodate yearly baselined budget imports into PPM for General projects in FY22. EPBCS Operating Plan budget allocations are posted to the GL using the “chart string” including the project segment as the basis to post in the GL.

Chapter 1.4: Nuances between PPM and GL Data

- Campus Operating Plan (EPBCS) allocations are in the General Ledger at the project level only and are visible together with PPM detailed expenditure data only through reporting. Allocations are visible with summarized expenditure data in the General Ledger.

- External revenue generated through PPM Contracts is visible on the contract at the task level, through MyProjects in OFC and through reporting at a detailed, task level and summarized in the General Ledger at the project level.

- External revenue not generated through PPM Contracts are in the General Ledger at the project level only and are visible together with PPM detailed expenditure data only through reporting. This revenue is visible with summarized expenditure data in the General Ledger. See section 2.3.2 for more information about the revenue distinctions.

- POET(AF) is used to transact in PPM whereas the chart string is used to transact in the GL. See section 1.5 for more information.

- POET or POETAF is only used in the PPM subledger not in the GL.

- PPM displays Payables costs at time of payment approval. The GL shows this expense and a payable liability when an invoice has been approved and shows a withdrawal of cash when paid. PPM tracks a Cost Commitment until the payable is paid.

Chapter 1.5: Coding Transactions to the PPM Subledger (POET/POETAF)

To code transactions to the PPM subledger, Project number, Organization, Expenditure Type, Task, Award, and Funding source must be provided. All transactions in PPM have four required fields and two (sometimes) optional fields:

| Name | Description | Required for |

|---|---|---|

Project Number |

The unique number that describes a project. These identical values will also appear in the COA as a value in the Project segment. | All transactions in PPM |

Expenditure Organization |

Organization generating the expense. Does not drive accounting-only reporting. | All transactions in PPM |

Expenditure Type |

The specific type of expense being incurred. The expenditure type is used to derive the account segment value in the COA, but expenditure types are more granular. There can be multiple expenditure types associated with a single account code, each with a different description. | All transactions in PPM |

Task Number |

The number that represents the project task incurring the expense. | All transactions in PPM |

Award Number |

The award to be used for this transaction. The base award number matches the Kuali Research (KR) award number. | Transactions against projects that have awards. |

Funding Source |

Name of the sponsor in KR for the external funding source. This is NOT the same as the Fund in the COA. This is also the name of any Internal Funding Sources (used for Cost Sharing). | Transactions against projects that have awards. |

Most Project creation and modifications are managed through PADUA. See How to use PADUA 2.0 for more information.

Chapter 1.6: How Costs are entered and accounted in PPM

- PPM offers Costing functionality and is most commonly transacted through Miscellaneous Cost Import (MCI). Central Offices also have access to create costs directly in the system.

- PPM creates its own overhead (burden) transactions.

- PPM creates accounting for costs that are imported from outside Oracle Fusion Payables through Subledger Accounting rules (SLAs). Examples of costs processed this way include:

- UCPath

- Recharge Operations

- There are occasions when transactions are created outside of PPM and OFC. In those cases, a transaction is imported into the GL via journal entry. In order to have it represented as an expense in PPM without having it duplicated in the GL, the imported transaction is designated as “costed and accounted” in PPM. That way it does not affect GL accounting. There are very few transactions imported this way. Examples of this include:

- ISIS transactions

- EPIC transactions

- Financial Control entries

- Costs for a project should always be reflected in PPM

- Costs must be incurred during award/project/task dates. In other words, the Expenditure Item Date of the transactions must be within the start and end dates of the task being charged to

-

- Expenditure Item (EI) Date: Date a cost was incurred (service or good provided)

- Project End Date: Date project ends. This is equal to the latest task end date

- For more information on Dates, see section 2.2.8.

- PPM Costs that are not able to be posted for date issues are considered Unprocessed Costs

- These must be corrected to be reprocessed or the cost posted to a different project

- PPM Costs that are not able to be posted for other control issues are considered Unprocessed Costs

- These must be corrected to be reprocessed or the cost posted to a different project

- See section 8 below for more information

PPM Commitments are a type of cost to represent an obligation to pay, but is not yet a project cost. An example of this is a Purchase Order or subcontracts. More information on Commitments can be found at Commitments in OFC.

UC San Diego 9500 Gilman Dr. La Jolla, CA 92093 (858) 534-2230

Copyright © Regents of the University of California. All rights reserved.

1.6.1: PPM Subledger Accounting Rules (SLAs) overview

SLAs are built based on logic to derive each chart segment. The current system configuration has multiple rules not captured in the table below. SLAs are subject to change based on requirements. Each entry drives a journal to the GL. Journals are always two lines per entry (could be summarized).

This table represents the expense and revenue SLAs for PPM (all subledgers have their own SLAs). The correlating entry (usually a liability or balance sheet account) is not represented here.

| SLA | Correlating Entry |

|---|---|

| Segment | PPM Data element derived from |

| Entity | Based on the FinU |

| Fund |

SP: Based on the Award Type GP and CP: As entered on the task on the Project or Contract |

| Financial Unit (FinU) |

Based on the Project Owning Organization (costs) or Contract Owning Organization (revenue) CP: NICA for CAMPUS, Balance Sheet for Health |

| Account |

Based on the Expenditure Type for expenses Based on the contract for revenue |

| Function |

SP: Based on the Award Purpose GP and CP: Based on the function entered on the task |

| Program |

SP: N/A GP and CP: Based on the program entered on the task |

| Location |

SP: N/A GP and CP: Based on the location entered on the task |

| Project |

Based on the project being expensed to or billed off (revenue from contract) SP: Project not on revenue |

| Activity | n/a not used for PPM activity |

| InterEntity | n/a - system derives value |

General Projects and Capital Projects leverage DFFs to capture values for the SLAs to use

1.6.2: Defined Flex Fields (DFFs)

Defined Flex Fields are fields that Oracle provides that customers can customize for their needs. These fields can be a variety of types of field types such as free form, checkbox, or list.

When General and Capital Projects are setup, there are 4 DFFs on the Task that are available to enter segment values to drive SLAs. These are Fund, Function, Program, Location. Fund and Function are required.

On General and KR Service Agreement Contracts, there are 2 DFFs on the Contract for fund and account to drive the revenue and AR SLAs.