Expense Types vs. Expenditure Types

This page is designed to help faculty and staff distinguish between Expense Types and Expenditure Types.

In Concur, an "Expense Type" is the system's required categorization of expenses within an expense report. An "Expenditure Type" is part of the POETAF accounting string. It is a required field when using a Project and Task.

Events, Other Reimbursements & Procurement Card Expense Types

One of the Concur 2.0 enhancements is that the taxable status of the Expense Type will now be visible. If the Expense Type that you select does not have the word “taxable” next to it, that means that it is non-taxable.

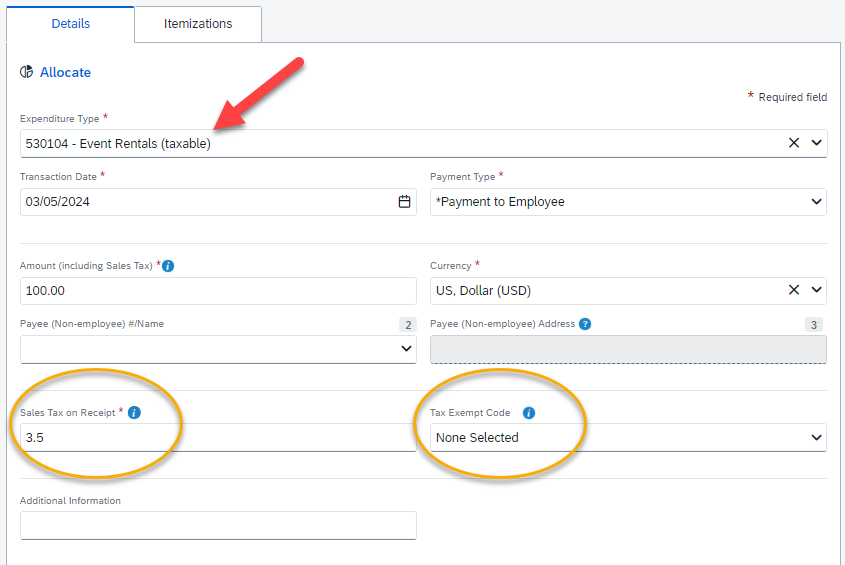

In the screenshot below, the Expense Type 530104 - Event Rentals (taxable) which means that you either need to enter the amount of Sales Tax paid or select one of the Tax Exempt Code options. You will only be able to see if an Expense Type is for Events, Other Reimbursements (Non-Events) and Procurement Card policies in Concur.

Trip Expenditure Types

The expenses added to a Travel Expense Report are not taxable. You will select the Account Code associated with your business trip at the Report Header level under the field named Trip Expenditure Type. The Account Code that you select will copy down to the expenses that you add to your Travel Expense Report.

For a list of Travel-related "Trip" Expenditure Types, see the Common Expenditure Types Blink page.