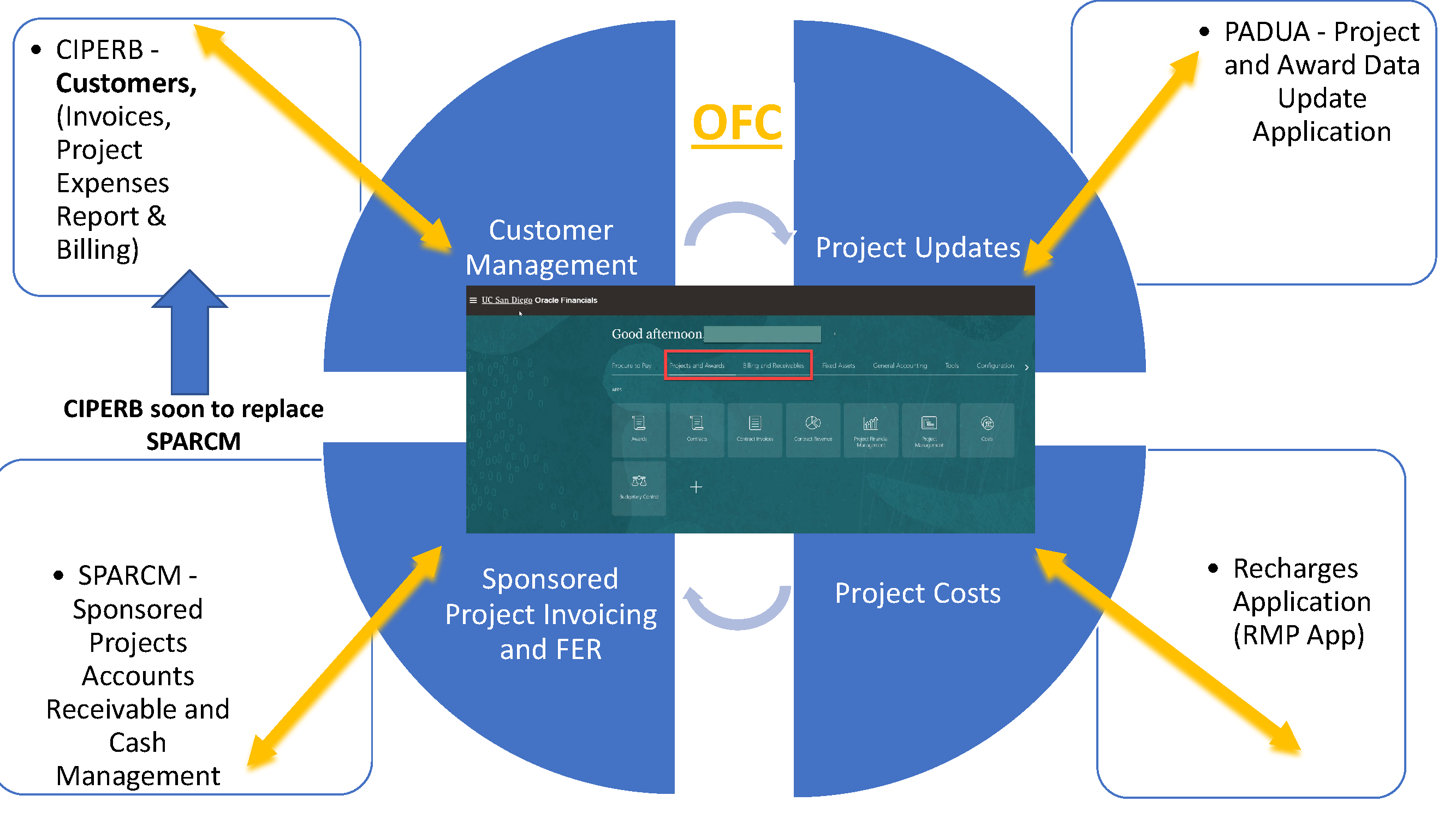

CIPERB: Customers, Invoices, Project Expenses Report & Billing

CIPERB is a new tool that provides full functionality for managing customers within the Accounts Receivable module of the OFC application. Customer data created or updated in CIPERB is synchronized in real time with Oracle, improving data accuracy, customer experience, and operational efficiency. CIPERB also supports enhanced billing processes, including Mass Event Creation for PPM Contracts, which allows users to quickly create multiple events across one or more contracts as a faster alternative to the PPM Contract Invoices screen. In addition, Mass Invoicing in Receivables enables users to upload, manage, and post multiple invoices in bulk, reducing manual effort, minimizing errors, and increasing productivity. Together, these capabilities make CIPERB a centralized, efficient solution for customer management, contract event creation, and receivables invoicing.

Training Course

The CIPERB:Customers course is located in the UC Learning module for immediate CIPERB training and access. Please log into the UC Learning platform to access the CIPERB: Customers, Invoices, Project Expenses Report & Billing eCourse. Completing this course will be essential to the customer account creation and amendment process since the former process of submitting request forms has been phased out as of July 1, 2024.

*This course must be completed prior to requesting role access to the CIPERB application*

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Launch CIPERB: Customers, Invoices, Project Expenses Report & Billing

*Access to CIPERB requires VPN connection*

For additional support, reference KBA KB0035096 - How To Use The CIPERB Application For Customer Accounts in Oracle.

Definitions

-

Customer: A customer is a person or business that UCSD bills for services it provides. Customers can be individuals, organizations, or businesses with which UCSD has a selling relationship (i.e., purchases, agreements, etc.).

-

In Oracle, this is referred to as a Party or Registry ID.

-

-

Supplier: A supplier is a person or business that provides services or products to UCSD, and UCSD pays them for their services.

-

If you need to create a supplier account, use PaymentWorks instead.

-

- Customer Account: A customer account represents the details of the business relationship between UCSD and a customer. This includes the terms and conditions of doing business with UCSD.

-

You can create multiple customer accounts for a single customer. For example:

-

Sponsored Research

-

Service Agreements

-

Consulting Services

-

These accounts allow UCSD to track different types of sales or services under one customer.

-

-

Contact: A person who communicates or acts on behalf of a customer or customer account. Contacts can be added:

-

At the customer level internally.

-

At the account or address/site level. Multiple contacts can be added per account.

-

-

Sites/Addresses:

-

A site is the physical location of the customer.

-

Party sites are added internally at the customer level but are created at the account level.

-

An account site is a location used in the context of a customer account.

-

Multiple sites can be added to a single customer account.

-

Roles & Access

CIPERB Application Roles Overview

The following primary roles are defined for the CIPERB application:

| Role Name | Role Description | Role Workflow |

|---|---|---|

|

UCSD CIPERB Read User JR |

User can View any data in CIPERB |

No workflow required—anyone can have this role |

| UCSD CIPERB Manage GP User JR |

User can only view Non-SP Data (non-sp customers, no FER, etc) |

Access limited to non-sponsored data |

| UCSD CIPERB Manage Customer ALL JR |

User can create/edit Customers (Parties) |

Requires department approval and AR team approval |

| UCSD CIPERB Manage Customer Accounts Only JR |

User can create/edit Customer Accounts |

Requires department approval |

| UCSD CIPERB Manage Events JR |

User can create and release a large number of events |

Requires department approval |

| UCSD CIPERB Manage Invoice JR |

User can upload mass receivables invoices |

Requires department approval |

Role Combinations

-

UCSD CIPERB Manage GP User JR + UCSD CIPERB Manage Customer ALL JR: This combination grants the ability to manage both customers and accounts (GP Super User).

-

UCSD CIPERB Manage GP User JR + UCSD CIPERB Manage Customer Accounts Only JR: This combination allows users to add or edit other customer accounts (excluding customer parties).

Training Requirements for Role Requests

The Oracle & Concur Role Request Form in Services & Support has been updated. Users requesting OFC inquiry roles and higher-level access must complete specific training courses in UC Learning.

To learn more about training requirements, please visit the Finance Training Program in Blink.

Role-Specific Training Details

Oracle Foundations Training (Required for the following roles):

-

All standard roles for all business units (except for UCSD BI Consumer JR).

-

All financial unit approver roles (e.g., UCSD WF XXXXXXX Approver JR).

-

All cost transfer approver roles (e.g., UCSD WF XXXXXXC Cost Adjustment Approver JR).

-

All elevated roles for all business units.

CIPERB Training (Required for the following roles):

-

CIPERB Read User JR

-

CIPERB Manage Customer Accounts Only JR

-

CIPERB Manage GP User JR

-

CIPERB Manage Customer ALL JR

Additional Information

For detailed information about Oracle and Concur role requests, refer to the following resources:

-

KB0035155 - How to Request CIPERB Roles to Create & Edit Customers (Parties)

-

KB0035154 - How to Request CIPERB Roles to Create & Edit Customer Accounts (Not Parties)

Additionally, the Internal Controls Checklist has been updated to reflect the release of the new Consolidated Exceptions Report. Please download the latest version from Blink: Best Practices in Internal Controls.

Mass Events Upload

Mass Event Creation for PPM Contracts

This tool streamlines the process of creating multiple events for one or more contracts, offering a faster alternative to using the PPM Contract Invoices screen.

-

Scope: This feature handles only the Event steps in the PPM invoicing process.

-

Note: It does not bypass other steps in the PPM invoicing workflow.

-

Next Steps: For guidance on completing the full PPM contract and invoicing process, refer to KBA KB0032314 or visit the Contract and Invoice Creation Blink page.

-

User Role Required: UCSD CIPERB Manage Events JR role.

Resources

Mass Invoicing in Receivables

Efficient Mass Invoicing for Receivables in CIPERB

KBA KB0035678 provides a comprehensive, step-by-step guide to navigating the CIPERB application, designed to simplify financial operations for all users involved.

With this new feature, users can easily manage and upload multiple receivables invoices, as well as post transactions. By streamlining these processes, it reduces errors and boosts productivity, ensuring a more efficient invoicing experience.

This feature is an essential tool for managing mass invoicing of receivables in CIPERB, providing a smoother, error-free workflow.

Resources:

CIPERB Flowcharts

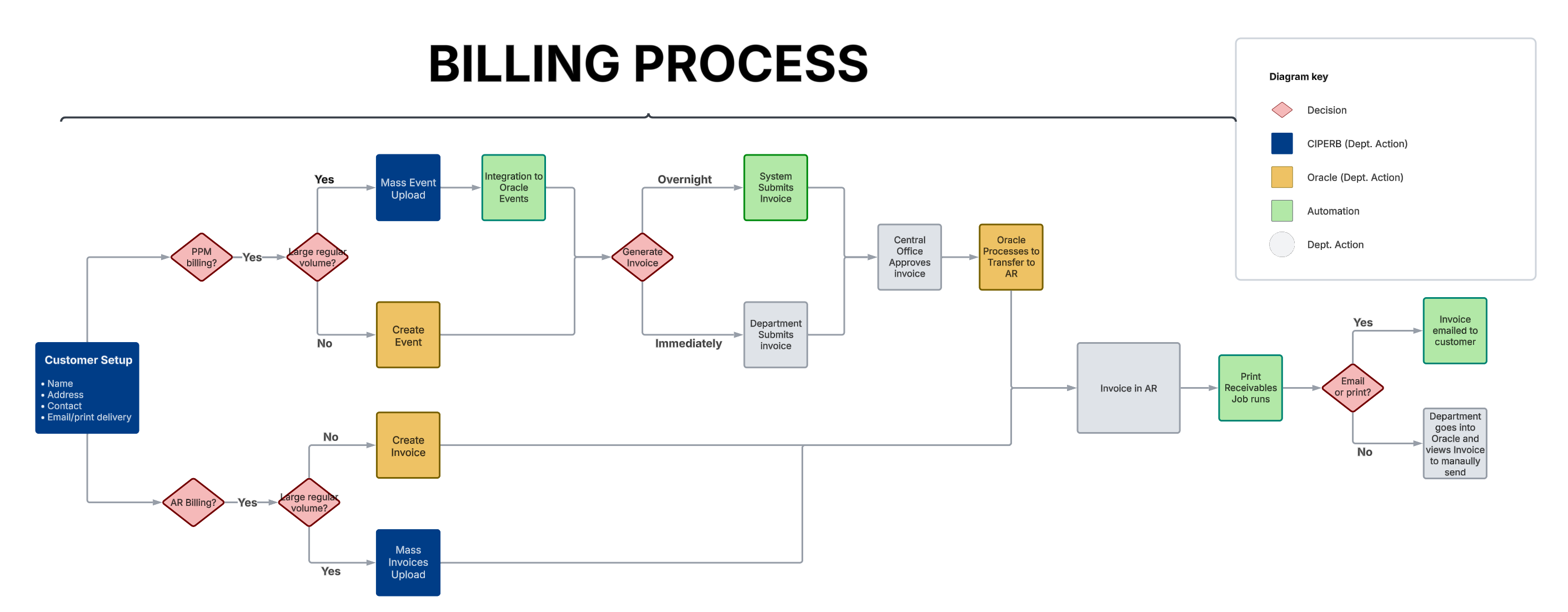

Billing Process Flowchart

Corresponding Oracle Applications

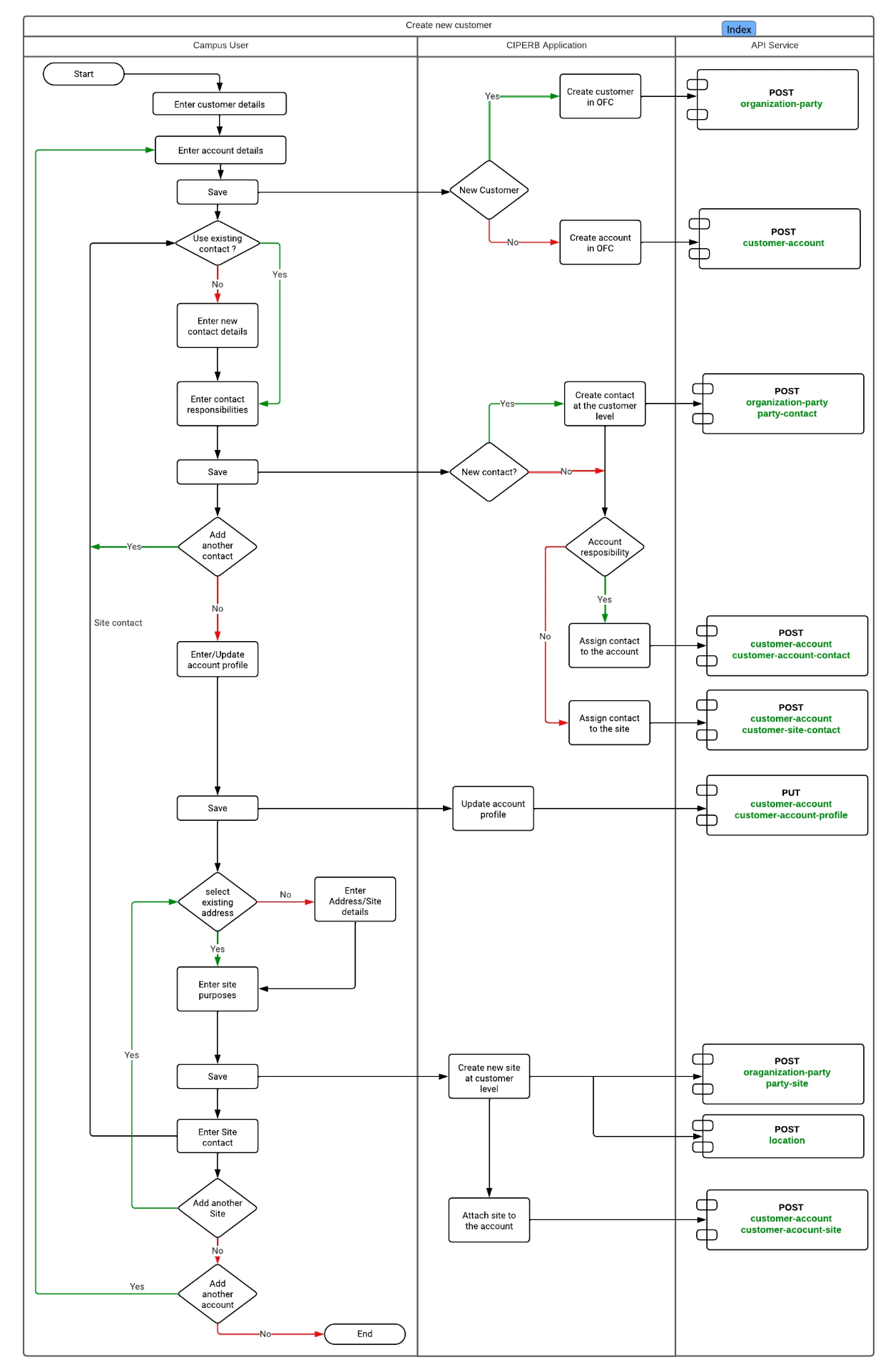

New Customer Flowchart

Additional Resources

Knowledge Based Articles (KBAs)

- KB0035096 - How To Use The CIPERB Application For Customer Accounts in Oracle

- KB0035287 - How to Create & Upload Mass Events in CIPERB

- KB0035678 - CIPERB Mass Invoicing in Receivables

- KB0032971 - How to Search for a Customer

- KB0032171 - Customer Accounts in Oracle/CIPERB

- KB0032200 - How to Determine the Oracle & Concur Standard Roles Departmental Preparers Need

- KB0035155 - How to Request CIPERB Roles to Create & Edit Customers (Parties)

- KB0035154 - How to Request CIPERB Roles to Create & Edit Customer Accounts (Not Parties)

- KB0035287 - How to Create & Upload Mass Events in CIPERB

Additional CIPERB Requirements: Customer Tax Identification Numbers (TINs)

The CIPERB application requires the use of Tax Identification Numbers (TINs) for new customer accounts. A TIN (whether domestic or foreign) is essential for a variety of reasons related to financial and regulatory processes. However, this does not apply to individual "person" accounts (SSNs are not required for these accounts). Below are key points outlining the importance of TINs for customer accounts:

-

Customer Identification & Verification

A TIN is crucial for uniquely identifying customers for tax purposes. It ensures reliable verification of a customer’s identity, which is important for financial transactions and regulatory compliance. -

Tax Reporting & Compliance

For businesses, having a customer's TIN is necessary for accurate tax reporting. It helps ensure compliance with tax obligations, such as issuing 1099 forms (in the U.S.) for certain transactions. -

Preventing Tax Evasion

TINs play a key role in preventing tax evasion. They ensure that income is properly reported to tax authorities, reducing the possibility of individuals or businesses concealing income. -

International Transactions

For international trade, TINs are often required for customs clearance and tax compliance. They help identify the parties involved and ensure adherence to tax laws in different countries. - Foreign Tax Requirements

For foreign customers, a valid foreign TIN is required to meet country-specific tax regulations, including withholding tax, VAT/GST reporting, and other international tax compliance obligations. This ensures accurate taxation and proper reporting for cross-border transactions. -

Credit & Financial Transactions

Financial institutions may use TINs for credit checks and to assess customers' creditworthiness. They are also required when opening bank accounts or applying for loans. -

Legal & Regulatory Compliance

Many jurisdictions require the collection of TINs for specific transactions. Non-compliance can lead to penalties or legal consequences. -

Business-to-Business Transactions

In business transactions, TINs are typically needed for invoicing, accounting, and managing accounts receivable/payable, ensuring smooth business operations.

Recommended Methods to Obtain a Foreign Company’s TIN

-

Customer-Provided TIN During CIPERB Onboarding

As part of customer setup in CIPERB, foreign business customers should provide their official foreign TIN. This information is entered into CIPERB and synchronized in real time with Oracle AR to support accurate tax determination, invoicing, and compliance. -

Verification via Supporting Documentation

When required for validation or audit purposes, users should request supporting documentation from the customer, such as:-

Foreign business registration or incorporation documents

-

VAT/GST registration certificates

-

Tax residency certificates

These documents help ensure the TIN entered in CIPERB is valid and consistent with Oracle AR tax requirements.

-

-

Engagement of Local Tax or Legal Representatives

If a foreign customer does not yet have a TIN, they are responsible for working with a local tax advisor, accountant, or legal representative to complete registration with their country’s tax authority prior to customer activation in CIPERB. -

Compliance Review Prior to Transaction Processing

Customer accounts missing required foreign TINs should not proceed to invoicing or receivables processing in Oracle AR until the information is obtained and validated. This helps prevent tax reporting errors and downstream invoice rejections. -

Documentation and Audit Readiness

All foreign TINs entered in CIPERB should be supported by customer-provided documentation and retained according to record-keeping policies. This ensures audit readiness and ongoing compliance with Oracle AR tax and reporting controls.

Demo & Training Videos

For additional assistance, please submit a Services & Support ticket to the following:

- I want to: Ask a Question or Make a Request

- About: Financial Accounting

- Related to: Oracle Project Portfolio Management

- More Specifically: CIPERB (Customers, Invoices, Project Expenses Reporting & Billing) Inquiries

Find answers, request services, or get help from our team at the UC San Diego Services & Support portal or call the Finance Help Line at (858) 246-4237.