Employee Non-Cash Gifts and Awards

Find out how to award employees with non-cash awards and give gifts in certain circumstances.

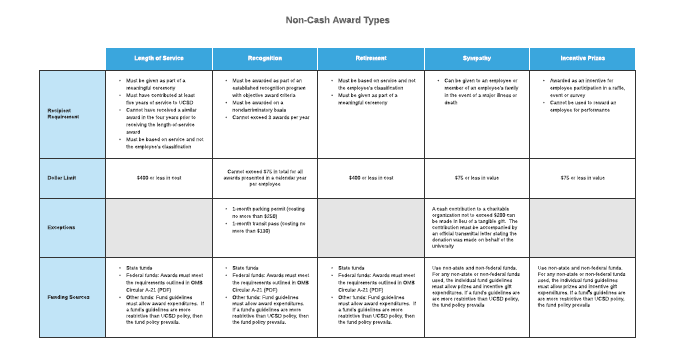

Departments can present employees with non-cash awards to recognize accomplishments, length of service, retirement, as an expression of sympathy or as an incentive prize.

Approval

Department heads have the authority to approve transactions.

Exceptions

An exception to the per-person limit outlined below will create additional taxable income for the employee and should be avoided. Disbursements will review requests for exceptions on a case by case basis to determine if the exception is allowable.

Payment

For Disbursements gift card, reimbursement or direct payment, use Concur Request type Gift Cards & Human Subject Payments; Expense type 536200 - Gifts/Awards for Employees.General Guidelines for Purchasing Gift Cards and Certificates

To qualify as a non-cash award, gift cards and certificates must be non-negotiable and redeemable as tangible personal property.

A gift card or certificate is considered tangible if it is:

- Inscribed with the recipient's name

- Not transferable

- Not redeemable for cash

- Not redeemable for payment on the balance of the recipient's account with the merchant

- Not redeemable for services, such as a facial, spa treatment, golf lessons, etc.

- Not purchased for less than $10 (Under California law, cards with a value less than $10 are redeemable for cash)

- Note: If a gift card cannot be inscribed with the recipient's name, the department should inform the employee that the card is non-transferable. Having the name inscribed on the card is preferred as this provides the optimum documentation for meeting IRS guidelines.

When vendor requests payment using wire transfer, see how to request a wire.

You may not use a Department Order, Procurement Card, or Oracle to purchase gifts because these processes do not allow for approval by the appropriate person. There are no exceptions to this policy.

Purchasing gifts is not allowed for occasions that are personal in nature, such as:

- Gifts of cash, except donations to a charity as an expression of sympathy

- Negotiable gift certificates and cards

- Gift certificates and cards for services

- Recreation memberships

- Season tickets to sporting or cultural events

- Gifts provided to employees in connection with birthdays, weddings, anniversaries, holidays, farewells, graduations and other occasions of a personal nature

Award Limits and Taxability

| Award or Gift | Per-Person Limit* | Tax Treatment if Limit Exceeded |

|---|---|---|

| Employee Recognition (including Spot Awards) | $75 | A |

| Employee Recognition: 1-month parking permit | $250 | C, D |

| Employee Recognition: 1-month transit pass | $130 | C, D |

| Length of Service | $400 | B |

| Retirement | $400 | B |

| Sympathy Gift — Tangible Personal Property | $75 | A |

| Sympathy Gift — Cash Contribution | $200 | E |

| Prizes and Other Gifts | $75 | A |

Notes:

- If the cost (or value) of the award or gift exceeds $75, the minimum limit under I.R.C. Section 132(e), the entire amount is taxable. The $75 limit is per award, up to 3 awards per calendar year.

- If the cost (or value) of a length-of-service or retirement award that is tangible personal property exceeds $400, only the amount in excess of $400 is taxable to the employee. Note that gift cards of any value that are provided for a length of service or a safety award are not considered tangible personal property and are subject to withholding as wage income.

- If the cost (or value) of a monthly parking permit or transit pass award exceeds the per-person limit, only the amount in excess of the limit is taxable.

- The award amounts conform to the monthly pretax transportation limits that are indexed for inflation by the IRS.

- Since a contribution made to a charity must be made in the university's name, there is no tax consequence if the limit is exceeded.

*The per-person limits exclude incidental costs for engraving, packaging, insurance, sales tax, mailing, delivery, and gift wrapping that does not add substantial value to the gift. The per-person limit of $75 is per award, no more than 3 awards per year; aggregating the amounts is not allowable (i.e. each award cannot exceed $75 otherwise the entire amount is taxable).

** It is the department's responsibility to track and report relevant information to their HR office for income tax purposes. HR will then report this information to UCPath, and it will subsequently appear on the employee's W-2.

Sympathy Flowers

Sympathy flowers is a common type of employee gift processed through our systems. Please note the following guidelines when purchasing sympathy flowers:

- Sympathy flowers should be purchased via an invoice and submitted through a Payment Request. This is not an allowable purchase on the Procurement Card or the Travel & Entertainment Card

- The maximum purchase amount for sympathy flowers is $75 (excluding tax, delivery, and any other additional fees)

UC San Diego has three preferred florists that are able to provide floral arrangements within policy limits.

Flowers By Coley - Supplier # 15749

Adelaide's (La Jolla) - Supplier # 10184

Mission Hills Florist - Supplier # 234266

Once the flowers are ordered, please submit either a Payment Request (Gifts & Awards) for direct payment to the florist (if paying via invoice), or complete a Non-Event Reimbursement in Concur (if an employee is paying out of pocket). Use the Expense Type 536200 - Gifts/Awards for Employees when processing the Non-Event Reimbursement.

Types of Employee Non-Cash Gifts and Awards

Examples

- Disbursements Gift Card

- Flowers

- Plants

- Fruit

- Books

- Ticket to a sporting or cultural event (season tickets excluded)

- Plaque

Overview of Non-Cash Award and Gift Types

Quantity Purchases of On-The-Spot Recognition Awards

Non-cash employee recognition awards (usually gift cards) given throughout the year to recognize an individual or team effort are oftentimes referred to as "on-the-spot" awards. A department might award an employee with a single recognition award not to exceed $75 in a calendar year, or can award an employee up to 3 awards per year (not to exceed $75). These on-the-spot awards can be purchased in advance quantities if the following rules are followed:

- Gift cards are kept in a secure place

- Proper documentation of gift card and certificate use is maintained

- Gift cards aren't purchased in quantities greater than what is to be awarded in a fiscal year

- The value of the gift card or certificate does not exceed $75