GL-PPM Reconciliation

The GL-PPM Reconciliation report displays differences between amounts in General Ledger and amounts in PPM. A drillthrough report identifies the specific transactions that are causing the differences. Reconciliation of GL to PPM on sponsored projects is a required key control. Users may also wish to reconcile differences between GL and PPM for general projects. A Resources tab displays amounts on general projects that do not post as costs to PPM and should be included in a PPM Budget.

The GL-PPM Reconciliation report is available from the Business Analytics Hub (bah.ucsd.edu) under the Exceptions and Reconciliation tab.

Report Demo

You can find the GL-PPM Reconciliation Report Demo on the UCSD Budget & Finance YouTube channel, BI & Financial Reporting playlist.

Access

Access has been provisioned to anyone with the Oracle BI Consumer JR role. Staff who do not have access should request the Oracle role. Access failure appears as error "Unable to load requested view. Displaying home view instead."

- Navigate to bah.ucsd.edu.

- Select Budget & Finance.

- If using the List View, look for GL-PPM Reconciliation Report in the list or use the search bar at the top right and click the dashboard name

- If using the Card View, click the Exceptions and Reconciliation tab and click Launch on the GL-PPM Reconciliation Report tile

- Use your Active Directory credentials to sign in, if prompted.

Navigation

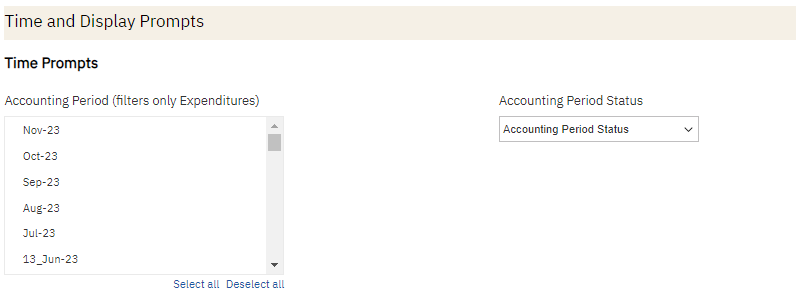

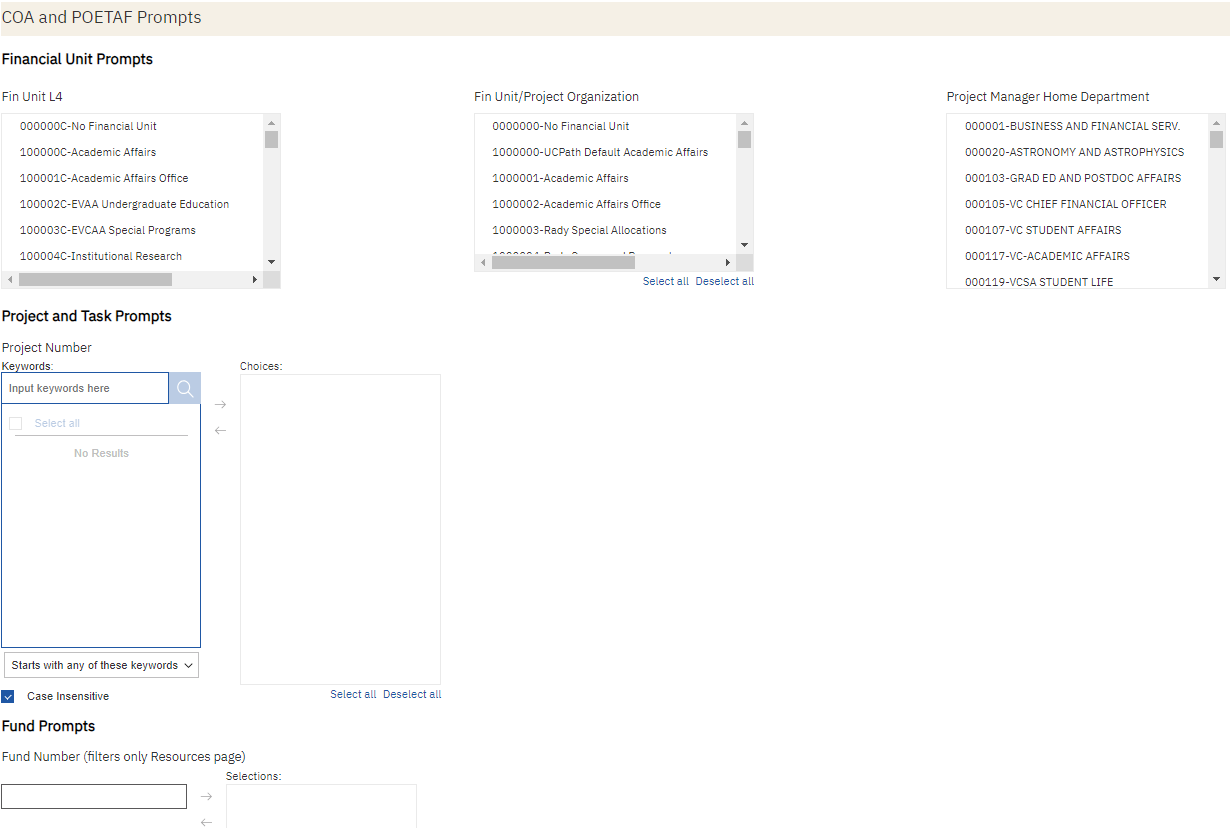

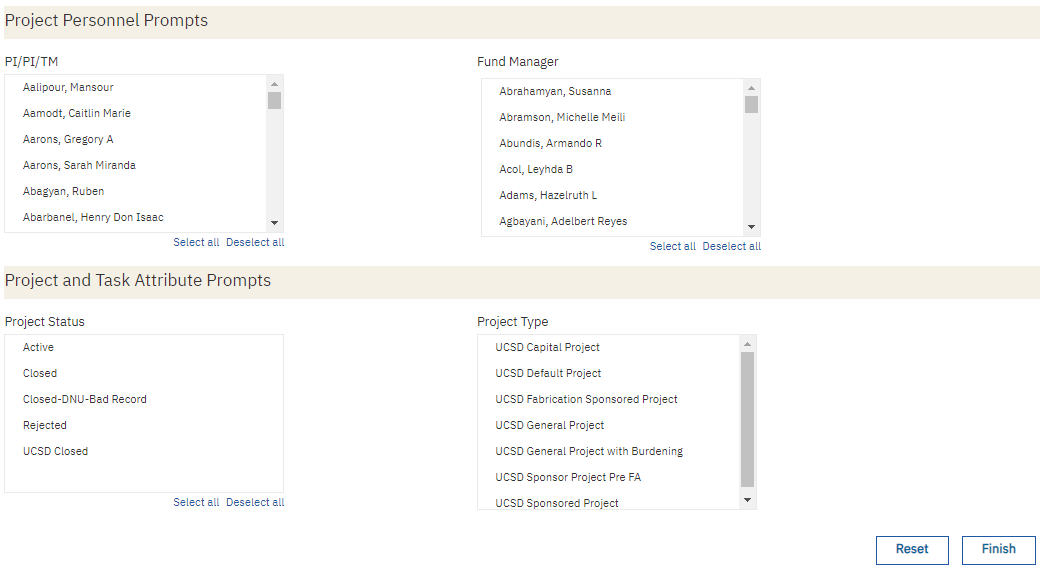

- Use these parameters to filter for the data you want to view

- These filters can be used in combination or individually to produce desired results

- One or more of the following prompts MUST be used:

- Project Manager

- Fund Manager

- L4 Financial Unit

- Financial Unit

- Project

- After entering one of the required prompts, click Confirm to verify that a required prompt has been used. This will cause the Run button to appear.

- The following prompts are optional:

- Project Type: This prompt can be used to limit the results to only sponsored projects

- Fund Number: This prompt has no impact on the Expenditures tabs, but can be used to filter the Resources tab

- Accounting Period: This prompt can be used to view only transactions that posted in certain accounting periods. Because differences can be resolved across different accounting periods, selecting only one or a few accounting periods is not recommended.

- Accounting Period Status: This prompt can be used to limit the results to only closed accounting periods. Differences may appear in open accounting periods that will resolve themselves when the period closes.

Report Pages

Expenditures Condensed

Displays variances by project and account. Any accounts with the same amount in GL and PPM will not appear, and any projects where the total variance across all accounts nets to zero will not appear.

Expenditures by Accounting Period

Displays variances by project, account, and accounting period. This display can help to identify the specific accounting period in which a variance occurred, but will also display variances that were corrected in a later accounting period.

Resources

Displays inception-to-date resource amounts in GL and compares to budget amounts in PPM for general projects. Use this tab to determine amounts that need to be entered in PPM budgets.

Report Specifications

Lists the filters that are applied in the report to generate GL and PPM amounts on each page.

What do I do when I find differences?

Click on the hyperlink for each difference identified on the report to view the transactions causing the difference.

The GL-PPM Details report has five data tabs:

- Payables Invoices: Invoices processed through the Payables subledger. Does not include cost transfers of invoices.

- Payables Payments: Early payment discounts on some invoices.

- Projects: General Ledger data includes all transactions with a Journal Source of Projects. PPM data includes cost transfers, UCPath transactions, recharges, and other transactions that are known to flow from PPM to the General Ledger.

- ISIS: Includes ISIS source transactions

- Other: Anything not included on another tab, including Receivables source transactions and manual journals.

You will typically only see transactions on one of the tabs, though you may sometimes see information on two or three tabs. If you see information on multiple tabs, compare the information between the tabs to identify any transactions where the GL transaction appears on one tab and the PPM transaction appears on a different tab. These situations are rare but must be taken into account before taking action.

All the corrections should be requested through the Subledger Transaction Correction Form, which includes a dropdown with different options to select depending on the transaction source of the discrepancy.

Payables Invoices

For invoices with amounts in GL and not in PPM, request an AP cost correction through the Subledger Transaction Correction Form (select Payables Invoices or Payables Payments from the dropdown menu).

Complete the Posted Payables Cost Transfer Request spreadsheet linked in the form by copying and pasting the information from the downloaded GL-PPM Details report into the spreadsheet. KB0033225 contains additional instructions on completing the form.

When invoices have been corrected, you will see two lines for the invoice on the GL-PPM Details report: one line for the invoice only in GL, and a second line right below it with a CT_ or CC_ invoice with an amount only in PPM. These opposite variances net to zero and can be ignored going forward.

If the invoice has an amount in both GL and PPM but the amounts are different, use the Transaction Details report to search for the invoice number to see the full picture. A part of the invoice may have posted to project 0000000 in the general ledger, or there may be other differences. Submit an AP cost correction request to correct any errors you find.

Payables Payments

Early payment discounts are sometimes on a different account code in GL vs PPM. Check amounts you see on this tab against the main report to see if these variances net out with an opposite variance on another account code. Any true discrepancies are often so small that they can be disregarded. For early payment discounts posted only to GL that must be corrected, complete and submit the Subledger Transaction Correction Form (select Payables Invoices or Payables Payments from the dropdown menu).

Projects

In rare cases, due to idiosyncrasies in how transactions post, some PPM transactions may appear on this tab, while the GL counterpart appears on a different tab. Check the other tabs to see if this is the case.

If the variances are from transactions posted in the current accounting period, wait until the accounting period closes. The variances may resolve themselves in a few days or weeks.

If you identify true variances on this tab, complete and submit the Subledger Transaction Correction Form (select Projects from the dropdown menu). If variances appear both in Projects and in another Transaction Source, always choose the latter.

ISIS

The ISIS tab displays a summary by Student PID as well as individual transactional variances between GL and PPM. Some rows may net out with other rows, and some associated data may be captured on the Projects tab. Possible causes of GL-PPM variances from ISIS:

- Transaction posted to project in the GL but default project in PPM

- Transaction posted to financial unit in GL not associated with project-owning organization

- Transaction posted only to GL OR only to PPM

- Transactions posted multiple times to GL or PPM and either were not corrected or corrections were done incorrectly

Regardless of the cause the action is the same:

- Complete and submit the Subledger Transaction Correction Form (select ISIS from the dropdown menu).

Other

Misc Receipts: If the Journal Category is Misc Receipts, the variance is due to an expense refund that was processed by the Cashier's Office only to GL. Negative variances on Payables-related accounts are probably misposted receipts. The Central Reconciliation team is rectifying these differences centrally and will reach out to your department if additional information is needed.

- Complete and submit the Subledger Transaction Correction Form (select Receivables and Cash Management from the dropdown menu)

- Reference the original case number, transaction number, and provide the PTF

Journals: If the GL Journal Category is Manual, the transaction is the result of a journal voucher. The Transaction Description and Journal Header in the report may give you information about which office submitted the journal. Reach out to that office for help with processing corrections. If the journal was prepared by a central office, request correction through the Subledger Transaction Correction Form and select Journal from the drop down menu.

Frequently Asked Questions

I clicked on a variance on the GL-PPM Reconciliation report, but none of the tabs on the GL-PPM Details report have any data. Is the report wrong?

If you run the GL-PPM Reconciliation report by financial unit, you may see variances on the report that are due only to differences in the financial unit. The transactions exist in both GL and PPM, but the financial unit on the transaction in the GL is different from the Project-Owning Organization in PPM. These kinds of differences will not appear on the GL-PPM Details report, because there is no true discrepancy between GL and PPM. Try running the GL-PPM Reconciliation report by project to see all of the transactions on the project regardless of financial unit.

Do I have to resolve variances on general (non-sponsored) projects?

It depends. If you use PPM-based reports to understand the balance of your projects, all transactions in the general ledger should be captured either in PPM Costs or in the PPM Budget. If you use GL-based reports to understand your project balances, capturing all transactions in PPM is not necessary. All sponsored projects are tracked and reported using PPM, so it is necessary to resolve all differences on sponsored projects. To see only sponsored projects on the report, use the Project Type filter on the prompt page.

What do I do if I see variances in the current accounting period?

There are sometimes minor timing differences between when transactions post in GL vs when transactions post in PPM. These differences typically resolve themselves at ledger close, so it's best to ignore variances in the current accounting period. Select 'Closed' from the Accounting Period Status filter on the prompt page to view only Closed Accounting Periods.

Do I have to resolve very small variances?

Due to rounding differences, there are sometimes variances of a penny to a few pennies on indirect costs on sponsored projects. These variances (under $1) can be ignored. Other variances on sponsored projects should be resolved.</p?

Release Notes & Communications

| Date | Release Notes & Communications |

|---|---|

| 12/12/2023 Budget & Finance Weekly Digest |

A Project Status prompt and column have been added to enable users to view GL-PPM variances for only Active projects. Prompt Page Redesign Changes were made to modernize and standardize the look and feel of the prompt pages across all financial Cognos reports. Specific changes that were made include:

|

| 3/7/2023 Budget & Finance Weekly Digest |

The following prompt has been added to this report: Project Manager Home Department |